Resale flat transaction volumes rose last month, following a relaxed income ceiling and higher grants. Prices are still mostly flat, however, and that’s unlikely to change anytime soon:

How many more flats were sold?

2,213 resale flats were sold in October, up from around 1,814 the month before. This is an increase of about 18 per cent month-on-month, and an increase of 10.6 per cent from October 2018.

Most of the units sold were four-room flats, accounting for around 41 per cent of total transactions. Four-room and three-room flats each made up about a quarter of total sales, with the rest being executive, 3G, and two-room flexi-flats.

However, resale flat prices are still in the doldrums

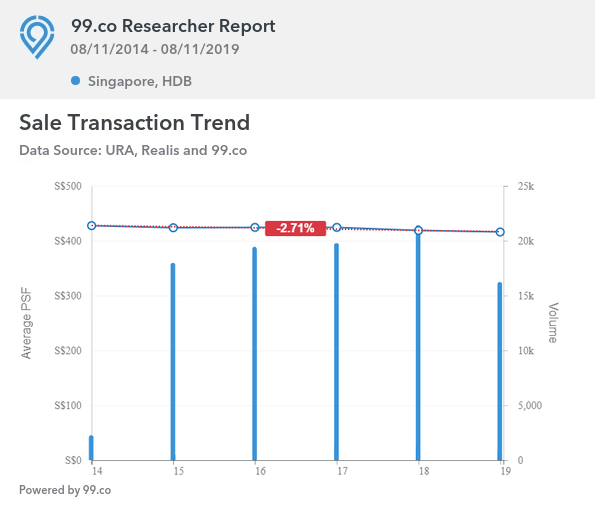

Resale flat prices dipped a further 0.2 per cent in October. The downward trend in resale flat prices has now lasted for about five years; across Singapore, resale flat prices are down about 2.7 per cent compared to 2014:

However, the decline in resale flat prices shows signs of slowing. According to The Business Times, younger flats (less than years old) saw a quarterly price decline of 2.5 per cent, as opposed to 4.8 per cent in the same time last year. Likewise, older flats (40 years and above) saw prices fall just 0.9 per cent in Q3 2019, from a much sharper 3.4 per cent dip in the same time last year.

Why is the volume of transactions rising?

One reason could be a recent tweak to HDB rules. Under the Enhanced Housing Grant (EHG), buyers can receive grants of up to $80,000 for both new and resale flats. Also, the income ceiling for HDB flats has been raised to $14,000, up from $12,000 previously.

Another reason is the large number of flats reaching their MOP this year. There’s increased availability of flats, including in desirable mature estates. Coupled with lower prices, this could prompt some buyers to consider resale instead of alternatives like BTO flats in less mature areas, or smaller condo units.

While sales volumes are likely to increase, prices are likely to stay flat

From our perspective, resale flat prices have little room to rise in 2019, or even in 2020. This can be chalked up to two main factors:

The first is the large amount of supply, from the sheer number of units reaching their MOP. Some 50,000 flats are expected to reach MOP in 2020 to 2021. With so many upgraders hoping to sell and upgrade, buyers have the clear upper hand.

The second reason is the emotional: HDB flats have gradually been re-positioned, from surefire investments to just “a roof over your head”. The renewed emphasis – particularly with growing worries of lease decay – has provided Singaporeans with a reality check. While we still see the occasional million-dollar flat, the days of sky high Cash Over Valuation (COV) are mostly at an end, barring significant shifts in government policy.

Does that mean now is a good time to buy a resale flat?

Resale flats have been affordable for a long time now – buyers today are no longer subject to high COV, which was practically a norm in the property heydays of 2009 to 2013.

Some buyers, being aware of the supply situation, may be thinking of waiting even longer – till about 2020 or 2021 for reasons mentioned above. However, remember that by then the location you want may no longer be available; nor is there a guarantee that the specific neighbourhood you’re after may see significant price drops.

Home buyers should stay focused on affordability, rather than trying to time the market. For those who buy today, it could be argued you’re already getting a better deal, compared to many buyers from the previous decade.

Are you eager to buy a resale flat anytime soon? Voice your thoughts in our comments section or on our Facebook community page.

Looking for a property? Find the home of your dreams today on Singapore’s largest property portal 99.co! You can also access a wide range of tools to calculate your down payments and loan repayments, to make an informed purchase.

3 days ago · 4 min read ·

Source: 99.co (11 Nov 2019)