Build-to-Order (BTO) HDB flats are supposed to be generally cheaper than resale flats. But at some point, chances are that you or someone you know—likely a first-time homebuyer—have complained that BTO prices seem to be getting higher and higher. Even with the provision of housing grants for those earning below a certain income, are BTO flats are less and less affordable in 2020.

In this article, we’re looking to answer the question “Are BTO flats getting more and more expensive?” once and for all. To do this, we’ll be comparing BTO prices over time within various locations in Singapore. Within each location, we’ll also compare BTO prices with prices of resale flats, because according to the government, BTO flats are priced using a methodology that takes into account prices of comparable resale flats in the vicinity, as well as the specific attributes of the flats, such as storey height and design.

Because amenities, such as MRT stations, also factor towards the pricing of BTO flats, we’ll also be taking this into consideration in some of our case studies.

Advertisement

BTO prices case study #1: Woodlands

Let’s start with a non-mature estate that has consistently seen plenty of BTO sales exercises over the past 10 years: Woodlands.

| Woodlands | BTO Starting Prices (excluding grants) | |||||

|---|---|---|---|---|---|---|

| Launched | Project Name | 3-room | 4-room | 5-room | Distance to MRT | Average 4-room resale price in preceding quarter |

| May 2011 | Woodlands Peak | $167,000 | N.A. | N.A. | Near | N.A. |

| September 2012 | Treetrail @ Woodlands | N.A. | $248,000 | $308,000 | Within walking distance | $394,801 |

| May 2013 | Woodlands Pasture I and II | $133,000 | $223,000 | $276,000 | Quite far | $418,811 |

| Novemeber 2013 | Admiralty Grove | $156,000 | $238,000 | $307,000 | Within walking distance | $413,172 |

| January 2014 | Woodlands Glen | $145,000 | $234,000 | N.A. | Within walking distance | $402,080 |

| May 2014 | Admiralty Flora, Marsiling Greenview | $144,000 | $229,000 | $308,000 | Within walking distance | $393,257 |

| May 2017 | Marsiling Grove, Woodlands Spring | $145,000 | $236,000 | $312,000 | Within walking distance | $351,301 |

| February 2018 | Woodlands Glade | $140,000 | $225,000 | $279,000 | Quite far | $339,235 |

| May 2019 | Champions Green | $165,000 | $244,000 | $336,000 | Within walking distance | $332,216 |

| August 2020 | Champions Bliss, Urbanville @ Woodlands | $184,000 | $276,000 | $405,000 | Near | $346,667 |

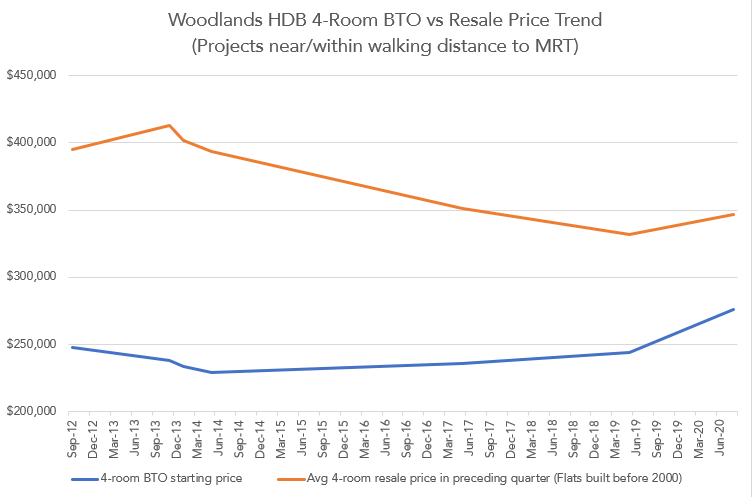

For Woodlands, let’s narrow the focus to BTO projects built within walking distance or near an MRT station as there is more such projects for us to chart a price trend over time.

Advertisement

Overall, for 3-room, 4-room and 5-room BTO projects in Woodlands that are within walking distance of an MRT station, we found that prices increased by 12%, 9% and 21% respectively over the seven-year period of 2013 to 2020.

This is significant because, during this period, resale prices—which are often thought to correspond with BTO prices—fell by up to 25% during the same period. If one of the key factors to determine BTO prices was prices of resale flats in the vicinity, then why did BTO and resale prices move in opposite directions?

What’s even more significant is that when Woodlands HDB resale prices finally bucked the downtrend recently, BTO prices increased by an even greater magnitude in the August 2020 BTO sales exercise.

In short, it’s reasonable to conclude that when HDB resale prices fall in Woodlands, BTO prices would increase. And if resale prices increase, BTO prices would increase even faster!

Granted, the projects launched in August 2020 are slightly nearer to the MRT station, but that alone cannot justify the crazy $32,000 increase in 4-room flat starting prices (more than 13%) between May 2019 and August 2020—a period of just 16 months!

BTO prices case study #2: Tampines North

Now, let’s take a look at Tampines North, a planned extention of Tampines New Town that will have its own MRT station on the Cross Island Line by 2029. The BTO flats that have been progressively launched here since May 2015 share largely similar attributes, because the area is so undeveloped.

| Tampines North | BTO Starting Prices (excluding grants) | ||||

|---|---|---|---|---|---|

| Launched | Project Name | 3-room | 4-room | 5-room | Average 4-room resale price in preceding quarter (Tampines New Town) |

| May 2015 | Tampines GreenWeave | $183,000 | $281,000 | $375,000 | $427,770 |

| August 2016 | Tampines GreenView, Tampines GreenVerge | $202,000 | $289,000 | $398,000 | $424,152 |

| November 2017 | Tampines GreenCourt | $216,000 | $323,000 | $438,000 | $435,561 |

| February 2018 | Tampines GreenDew, Tampines GreenFoliage | $205,000 | $296,000 | $417,000 | $432,283 |

| May 2018 | Tampines GreenVines | $210,000 | $312,000 | $422,000 | $430,743 |

| September 2019 | Tampines GreenGlen | N.A. | $312,000 | $418,000 | $427,343 |

| August 2020 | Tampines GreenCrest, Tampines GreenGlade | $205,000 | $311,000 | $423,000 | $412,189 |

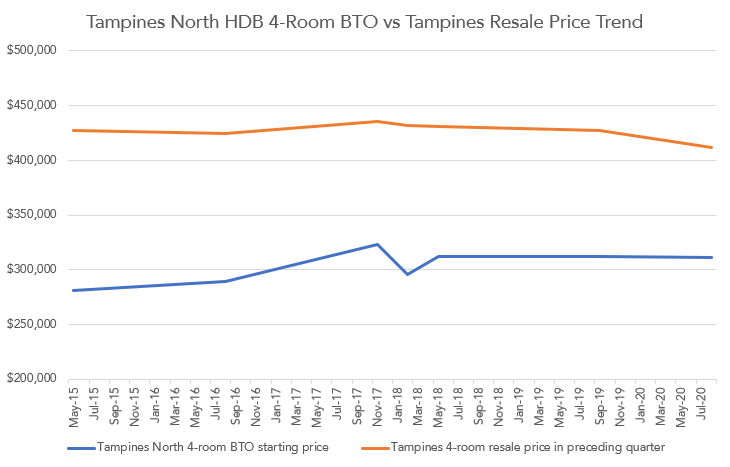

For BTO prices in Tampines North, we can see a discernable ‘bump up’ in BTO prices in November 2017 with the launch of Tampines GreenCourt, followed by an abrupt reduction in the subsequent sales exercise.

At the same time, there was a corresponding increase in 4-room resale prices in Tampines New Town, which could’ve prompted HDB to set their BTO prices higher in 2017, in line with their “methodology”.

Well, the November 2017 BTO sales exercise was a disaster. For a ‘mature estate’ project, Tampines GreenCourt was uncharacteristically undersubscribed by first-time buyers for 3-room and 4-room unit types. But this was no surprise, seeing as HDB had decided to jack up the price of 4-room flats by nearly 12% in a span of 15 months, when prices of resale flats had only increased by 2.7% in the same period.

Advertisement

This overreach prompted HDB to moderate the prices of Tampines North HDB flats from then on. But still, 4-room flats in Tampines North cost about 8% more now (in the latest August 2020 launch) than in 2016.

We feel that HDB might have went and increased prices further, had Tampines resale flat prices not fallen by 2.8% from 2016 till now.

BTO prices case study #3: Brickworks/Tengah

Before Tengah was announced as Singapore’s latest New Town in 2018 with plenty of bells and whistles such as parks everywhere and car-free transit corridors, HDB released thousands of BTO flats at the neighbouring Brickworks area in Bukit Batok from 2013 to 2017.

As Brickworks was also an undeveloped area back at the time, releasing a flurry of BTO flats there allowed HDB to calibrate the pricing for the eventual BTO projects at Tengah.

Based on the demand for Brickworks’ BTO flats, HDB could also better understand how to make Tengah, a brand new town, appear more attractive to Singaporeans.

It might seem cynical, but if the Brickworks’ BTO flats had sold like hotcakes (which they didn’t), there would conceivably have been far fewer amenities planned for Tengah, and Tengah BTO flats might cost even more than they currently do. Anyway, here’s the price analysis:

| Brickworks/Tengah | BTO Starting Prices (excluding grants) | ||||

|---|---|---|---|---|---|

| Launched | Project Name | 3-room | 4-room | 5-room | Average 4-room resale price in preceding quarter |

| November 2013 | West Ridges @ Bukit Batok | $169,000 | $284,000 | $373,000 | $451,068 |

| May 2014 | West Crest @ Bukit Batok, West Valley @ Bukit Batok | $164,000 | $265,000 | $371,000 | $446,527 |

| September 2014 | West Terra @ Bukit Batok | $167,000 | $269,000 | $361,000 | $440,097 |

| February 2015 | West Edge @ Bukit Batok, West Rock @ Bukit Batok | $160,000 | $259,000 | $350,000 | $436,907 |

| November 2015 | West Quarry @ Bukit Batok | $161,000 | $272,000 | N.A. | $406,052 |

| February 2016 | West Plains @ Bukit Batok | $163,000 | $266,000 | $367,000 | $404,432 |

| August 2017 | Sky Vista, West Scape | $171,000 | $265,000 | $353,000 | $408,438 |

| November 2018 | Plantation Grove | $193,000 | $290,000 | $397,000 | $401,126 |

| May 2019 | Garden Vale @ Tengah, Plantation Acres | $192,000 | $309,000 | $415,000 | $367,699 |

| November 2019 | Plantation Village, Plantation Grange, Garden Vines @ Tengah | $208,000 | $302,000 | $409,000 | $376,530 |

| August 2020 | Parc Residences @ Tengah | $198,000 | $303,000 | $418,000 | $353,896 |

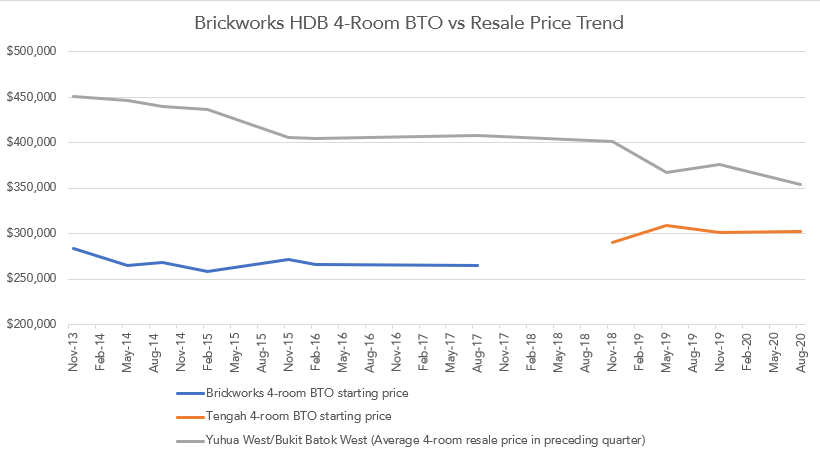

For resale prices, we used the two nearest neighbourhoods to Tengah (Yuhua West and Bukit Batok West) for accuracy. First thing we can see is that the decline in value for 4-room resale flats in these two neighbourhoods have been drastic throughout the period of our comparison—exceeding 20%.

The constant fall in the value of resale flats in the vicinity should have, according to HDB’s BTO pricing methodology, resulted in cheaper BTO flats in Brickworks over time, but we can see that wasn’t the case.

With superior amenities such as the future Jurong Region MRT Line and centralised cooling technology in units, Tengah’s BTO starting prices are, quite understandably, set at about 10 to 15% above the BTO prices seen at Brickworks. Since the launch of the first Tengah BTO project, Plantation Grove, in 2018, prices in Tengah have also shown an increase of 3%, 4% and 5% for 3-room, 4-room and 5-room unit types respectively.

As Tengah takes shape, we expect its BTO prices to continue its upward trajectory. Conversely, prices of resale flats at Yuhua West and Bukit Batok West, which were built in the mid-1980s, will likely continue to decrease. This can be attributed to the natural outcome of a dwindling 99-year lease, and also competition from flats in Tengah and Brickworks from buyers.

BTO prices case study #4: Bidadari

Bidadari, which is technically part of Toa Payoh New Town and considered a mature estate, arguably the second most publicised endeavour by HDB after Tengah, due to its proximity to the city.

Being sited on a recently exhumed cemetery hasn’t dimished Bidadari’s demand; all of its projects so far have been highly oversubscribed.

Here’s a snapshot of prices since the first Bidadari BTO project was launched in 2015, and 4-room resale flat prices in the nearby Potong Pasir neighbourhood:

| Bidadari | BTO Starting Prices (excluding grants) | ||||

|---|---|---|---|---|---|

| Launched | Project Name | 3-room | 4-room | 5-room | Potong Pasir 4-room resale price in preceding quarter |

| November 2015 | Alkaff Courtview, Alkaff Lakeview, Alkaff Vista | $297,000 | $433,000 | $544,000 | $495,125 |

| February 2016 | Alkaff Oasis | $303,000 | $440,000 | $546,000 | $431,250 |

| November 2016 | Woodleigh Glen, Woodleigh Village | $335,000 | $468,000 | N.A. | $467,750 |

| May 2017 | Woodleigh Hillside | $328,000 | $475,000 | $579,000 | $541,143 |

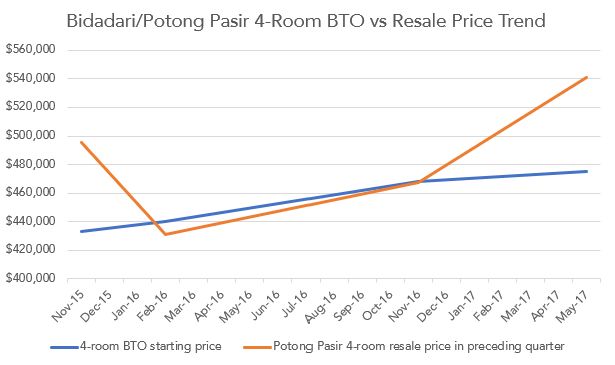

Without a doubt, we can see that HDB has been steadily raising prices for BTO flats in Bidadari for the past half decade. (Note that every BTO project at Bidadari is arguably within walking distance of a MRT station, be it Bartley, Woodleigh or Potong Pasir, so the ‘proximity to MRT’ factor in varying starting prices for Bidadari BTO flats should be minimal.)

Also, for the Bidadari projects, we are even seeing starting prices for BTO flats exceed that of average resale prices for nearby flats (unlike higher resale prices seen in non-mature estates). This is an indication that a higher land cost may have been factored into BTO flats at Bidadari.

Since the first Bidadari BTO project in November 2015, starting prices of 4-room BTO units there have increased by 9.7%. Starting prices of 3-room flats increased by an even greater magnitude, by 10.4%.

Advertisement

Potong Pasir’s flats were, similar to the resale flats in the previous case study, built in the mid-1980s. Despite being almost four decades old, the resale flats here have experienced value appreciation in the last few years. This is likely due to an increase in amenities surrounding Potong Pasir MRT, which includes the recently completed The Poiz Centre neighbourhood mall.

Considering buoyant resale prices in nearby Potong Pasir, we feel that HDB would have priced the Bidadari BTO flats even higher, or increased prices at a higher rate, if this wasn’t a former cemetery. And with at least two upcoming BTO launches in Bidadari in November 2020 and February 2021, we expect HDB to continue increasing prices for new flats here, regardless of how Potong Pasir’s existing flats perform in the resale market.

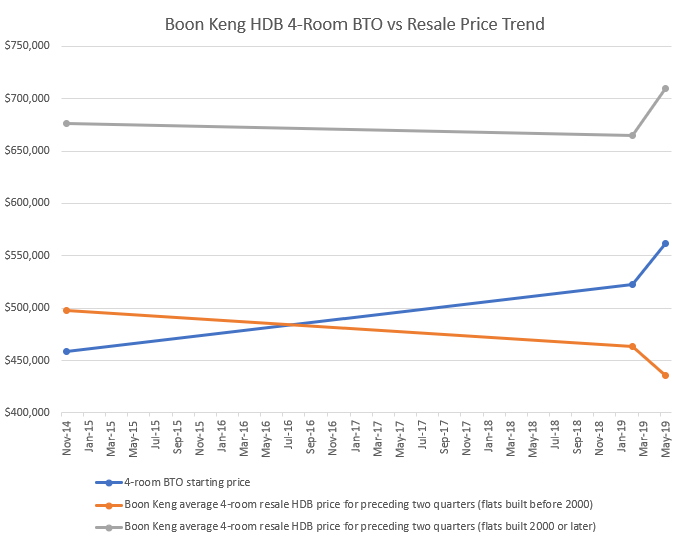

BTO prices case study #5: Boon Keng

Just minutes away from Orchard Road and the CBD by train, Boon Keng (in Kallang/Whampoa New Town) is home to the priciest BTO flats launched in Singapore. In the May 2019 launch, Kempas Residences set the record for the priciest 3-room and 4-room flats ever launched:

| Boon Keng | BTO Starting Prices (excluding grants) | |||||

|---|---|---|---|---|---|---|

| Launched | Project Name | 3-room | 4-room | 5-room | Average 4-room resale HDB price for preceding two quarters (flats built before 2000) | Average 4-room resale HDB price for preceding two quarters (flats built 2000 or later) |

| November 2014 | St. Georges Towers | $328,000 | $459,000 | N.A. | $498,222 | $676,000 |

| February 2019 | Towner Breeze, Towner Crest | $374,000 | $523,000 | N.A. | $463,214 | $664,556 |

| May 2019 | Kempas Residences | $387,000 | $562,000 | N.A. | $435,429 | $709,632 |

For our analysis of Boon Keng, we’ve spilt up older flats and newer flats, since housing here wasn’t built up at one go. There are a handful of 1970s flats, as well as blocks that are built after 2000. Due to differences in age, their resale value is quite far apart, as the chart above shows.

Even though BTO flats in Boon Keng are the most expensive BTO flats that HDB has launched, its starting price still pales in comparison to those of newer resale flats, which are fetching more than $650,000 for a 4-room unit.

BTO prices not a straightforward correlation with resale prices

You might also have noted that when prices for newer resale flats at Boon Keng increased while prices for older resale flats fell, BTO prices somehow ‘chose’ to follow the price spike of the newer flats.

This seems unreasonable at first, but it’s important to realise that when HDB says they “take into account prices of comparable resale flats in the vicinity” when pricing a BTO flat, they don’t mean literally following the price trends of ageing resale flats.

Advertsiement

Rather, what happens is likely this: HDB considers the age of nearby flats and applies calculations based on remaining tenure to find a hypothetical price as if the flats were brand new with a fresh 99-year lease, just like a BTO flat.

This explains why BTO prices will always lean towards the pricing of newer flats in the open market, while seemingly appearing to ignore the price trends of older resale flats in the vicinity.

But, even after taking into account tenure, it’s likely that HDB is still deliberately raising BTO prices across the board, with a mandate to slowly reduce the prized ‘BTO discount’ while gradually bridging the price gap between BTO and resale.

That’s because it’s ultimately hard to pinpoint a reason why starting prices for 4-room BTO flats near Boon Keng MRT increased 13.9% from November 2014 to February 2019, even as newer resale flats there had recorded a 1.7% price decrease.

This translates to a massive 15.6 percentage point price gap that tenure alone can’t explain, because the decrease in capital value for a 99-year leasehold property in the first 20 years of its lifespan is only 5%, according to Singapore Land Authority’s official leasehold table. (More in this article.)

Perhaps it’s the elusive land cost. Perhaps HDB realised on hindsight that the first project was priced way too low (the opposite of how the November 2017 Tampines North BTO project was priced too high).

Time for more transparency in BTO pricing?

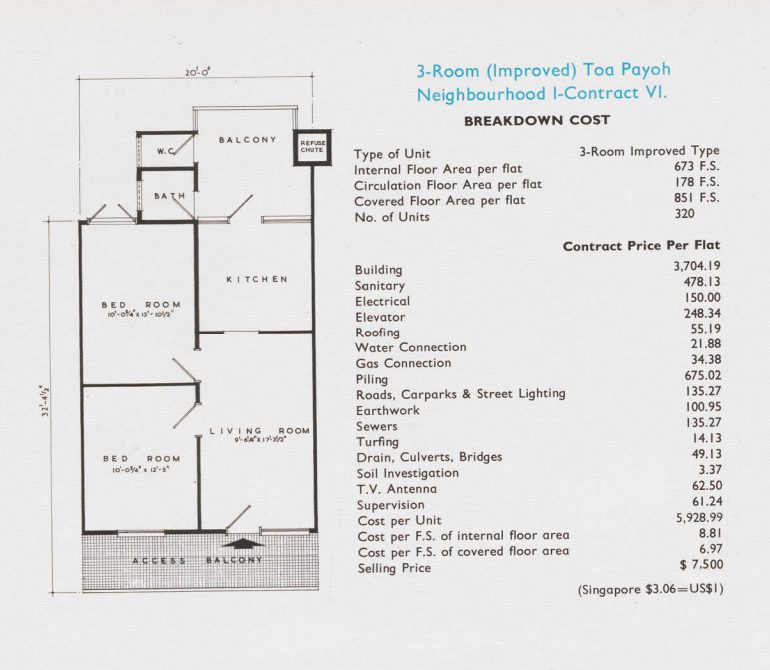

Actually, there was a time when HDB published cost breakdowns of new flats. The detailed breakdowns would appear in its Annual Report.

Sometime in the 1990s, the HDB stopped publishing these breakdowns, which was about the time when the government started factoring in land costs into the selling price of HDB flats.

No one has ever revealed, or ever managed to obtain, more information about the land cost component, or how prices of individual BTO flats are determined, even though the matter is legitimately of public interest. (Our sympathies to the parliamentarians over the years who have attempted this fool’s errand.)

In any case, as long as HDB and the government keeps its cards close to themselves and BTO prices keep increasing, Singaporeans will keep speculating: Perhaps there’s no methodology at all, only calculative madness.

7 days ago · 13 min read ·