5-room HDB flats have always been the dream amongst middle class Singaporeans. They’re big and spacious – especially the old ones built before 1997. Plus, they’re the closest thing to a condo some of us will ever get to.

On the other hand, their diminutive sibling, the humble three-room flat doesn’t get much love. They’re smaller and are often seen as ‘low-class’ options – as my snotty neighbour used to say back in the 1990s.

“You see ah girl, if you don’t study hard next time you’ll be low-class, live in three room flats” – I once overheard her telling her daughter ( and OF COURSE she went to an elite school named after an British coloniser).

Well, that’s entirely ridiculous back then (and now) simply because

1) the phrase ‘low-class’ is used by people who are indeed low-class,

2) a three-room flat is a genius choice for Singaporean millennials in 2019.

Allow me to explain.

Many millennials are opting for fewer (or no) children. All the more they should save on space and get a three room flat.

In case you missed it, Singapore’s birth rate is pathetically low. (It’s not even at the replacement rate, meaning that if it goes on, Singaporeans will be become extinct.)

The previous generation had two, three, four, or even five kids. Today, that’s the exception, not the norm. If that’s the case, do we really need that many extra rooms? Not really. These extra rooms, unless in the unlikely scenario are rented out, only serve to accumulate clutter and other unnecessary things (and maybe become a fire hazard in the near future).

If you can’t afford a big home, you’re stressing yourself for no reason.

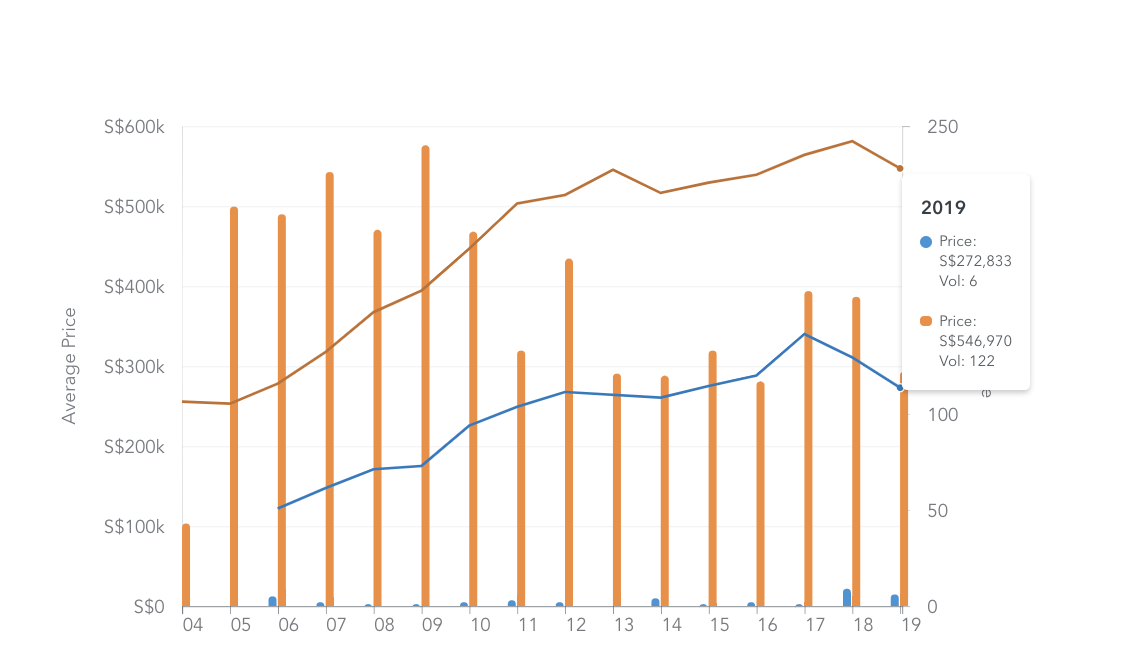

This doesn’t apply just to HDBs – but all to property in general. Land is expensive in Singapore. But you already knew that. That’s why the price difference between a 5-room HDB flat and a 3-room HDB flat in a mature estate can easily exceed $200,000 – take Clementi’s $274,137 price difference, for example.

Assuming in both cases, you apply for a $50,000 Family Grant – the monthly loan repayments will be $617 for the three room flat, and $1377 for the five room flat, or a difference of $760 per month. This might not seem much, but by the end of flat’s five year MOP, that would have been a difference of $40,200. That’s enough money for a nice emergency cushion for the family, or a decent amount to invest into the stock market to add towards a child’s education fund. Or going to a retirement fund for yourself or your elderly parents.

But what about HDB capital appreciation?

The 10 year capital appreciation for 3-room and 5-room HDB resale flats are 21.77% and 28.07 respectively. But keep in mind that these are 10-year-returns. Since 2014 where the government clarified that 99 years means 99 years, HDB resale prices have only slumped.

The big G has time and time again stressed that HDB prices will continue to be affordable.

While this means it’s a fantastic time to buy a HDB resale flat, it also means that in the future, it might terrible to sell your HDB flat. These days, the only way you can ‘make’ money with a HDB flat is through the BTO process, but even that may not be as lucrative as you think – after taking into consideration all the other costs people forget about.

Okay, so now what?

If nothing else, understand this from this article.

A caveat: If you know exactly what you want to do with the extra space, then please go ahead.

Before you raise pitchforks and accuse us about not ‘creating content for everyone’ and all that, we acknowledge that a three room flat just isn’t enough for everyone.

If you’re intending to have lots of kids to keep the species known as Singaporeans alive, or your elderly parents need to live with you – then you definitely need a bigger HDB flat.

5 hours ago · 5 min read ·