|

| General view of residential blocks against the Singapore skyline. (File photo: Jeremy Long) |

SINGAPORE: Rules for buying homes using Central Provident Fund (CPF) money and HDB housing loans will be updated on Friday (May 10) – a move “in the right direction” that will give home buyers here more flexibility, some industry watchers said.

The new rules could also sway demand for ageing homes, they added.

Citing changing needs and the higher life expectancy of Singaporeans, authorities on Thursday afternoon announced tweaks that will centre home-buying rules on whether a property can last a home owner for life.

Under the changes, as long as the remaining lease covers the youngest buyer to the age of 95, home buyers will now be eligible to take an HDB housing loan of up to the full 90 per cent Loan-to-Value (LTV) limit. This is even if the flat has less than 60 years left on its lease.

READ: New rules on buying properties using CPF, HDB housing loans to kick in on Friday

The total amount of CPF that can be used for property purchase will depend on whether the property's remaining lease can cover the youngest buyer to the age of 95.

WHO BENEFITS?

The changes mark a “step in the right direction” as it will provide buyers with more flexibility, said ERA Realty key executive officer Eugene Lim.

For instance, those looking to purchase older properties so as to stay near their parents will likely benefit, he said.

Older home buyers are also among the beneficiaries, said OrangeTee & Tie’s head of research and consultancy Christine Sun.

“Previously, older buyers may not be able to use CPF for flat purchases. But with the new regulation, some will be able to use CPF for their home purchase.”

This helps older buyers plan for retirement, as some may prefer to tap on their CPF funds for property purchases so as to set aside more cash for future expenses, she added.

The changes will also get the younger generation started on planning for the future, said Ms Sun.

Noting that retirement may not a priority for this group, she said: “Their lifespans may outlast the balance leases of their flats or they may over-commit financially and have insufficient funds for retirement.”

The latest rule changes should mean good news for home buyers in general, said Mr Lim, though there could be exceptions.

“Some buyers may be worse off if they buy a home with more than 60 years of lease left, but does not cover them to age 95.”

“In this instance, the amount of CPF funds they can use will be pro-rated under the new rules, but they would have not faced any restrictions previously,” he told CNA. “However, this group is a minority.”

BOON FOR AGEING PROPERTIES?

Industry watchers also said that the new rules could help burnish the appeal of ageing properties, both public and private.

Said CBRE head of research for Singapore and Southeast Asia Desmond Sim: “Existing owners of developments with 30 to 40 years left have effectively received a 10-year extension to their properties’ saleability.”

“Apart from unlocking additional value to older properties, this will also allay the fears of people owning ageing assets,” he added.

Echoing that, Mr Lim from ERA Realty said: “As the remaining lease is now not the only metric used for determining the usage of CPF funds, older homes may now be a little more appealing than they used to be.”

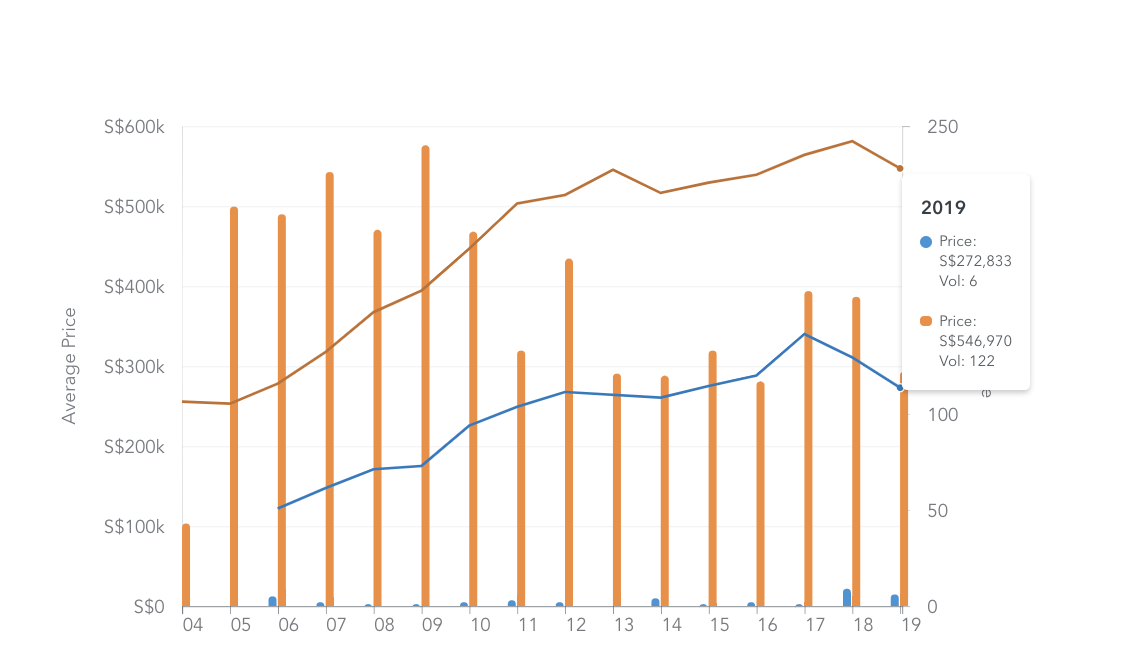

Previously, prices of properties with leases of less than 60 years were “depressed”, partly due to restrictions in the use of CPF funds, he added. “Now that has been changed – some buyers no longer face that restriction.”

This could boost demand for older homes, said Mr Lim, though prices are not expected to spike just yet.

“Buyers and sellers still have ready access to past transaction data and negotiations will likely settle around valuation," he said.

READ: Old HDB flats: Assets losing their value?

To be sure, there is one industry observer who holds a contrarian view.

Mr Lee Sze Teck, head of research at Huttons Asia, expects demand for older flats to be little changed.

“Although buyers can now use more CPF (funds) to buy older properties, the policies have increased the age to 95 and placed restrictions on withdrawal of CPF monies,” he said.

“Rather, it will encourage younger buyers to go for either BTO (Build-To-Order flats) or younger properties. Otherwise, they may not be able to withdraw their CPF monies if they do not meet the new criteria.”

The usual concerns over ageing properties remain as well, Mr Lee said: “Unless the price is really attractive, otherwise a buyer still looks at factors like flat condition. The lease issue will also be at play."

CONCERN OVER DEPRECIATING LEASES

The updated rules follow much discussion and concern over the issue of depreciating leases of older flats.

This topic has been in the spotlight since National Development Minister Lawrence Wong cautioned in a 2017 Facebook post that not all HDB flats will be eligible for the Selective En Bloc Redevelopment Scheme (SERS).

At last year’s National Day Rally, Prime Minister Lee Hsien Loong addressed home owners’ concerns about their flat leases and announced new schemes aimed at older precincts.

These include the Voluntary Early Redevelopment Scheme (VERS) and the new Home Improvement Programme II (HIP II).

READ: Owners of old HDB flats now know ‘there is some future': Experts on new housing schemes

READ: The Big Read: No easy answers to HDB lease decay issue, but public mindset has to change first

Yet, Ms Sun from OrangeTee & Tie thinks the headline-hogging public debate may not have been the catalyst for the latest rule changes.

“This, as they said, is to ensure everyone has a home when they retire. With an ageing population, there is also the need to help people to have enough retirement funds,” she told CNA.

“I don’t think they are using this to address the decaying lease issue directly because for that, the Government has rolled out other measures like HIP and VERS."

(Updated: )

Source: CNA/sk(hm)

Read more at https://www.channelnewsasia.com/news/singapore/new-cpf-hdb-loan-rules-may-make-older-properties-more-attractive-11519468