Fun fact: there are roughly 70,000 flats that are halfway through their lease, and will face lease expiry in the next 50 years. Before you buy one of them, we’d like to remind you that unlike STOMP articles, buying a home is a MAJOR life decision and shouldn’t be taken lightly. Consider EVERYTHING before you pull the trigger.

It’s getting easier for Singaporeans to buy old flats, and they are tempting

Thanks to the new CPF rules, you can now use the money in your CPF Ordinary Account (CPF OA) to buy a flat even if there’s just 20 years on the lease*. That doesn’t just impact the immediate affordability; it means there will still be some value in your 40+ year old flat, should you try to resell it later.

Of course, old flats are also more tempting, location wise. Have you seen what typically goes on offer at a BTO launch? New flats tend to be in less mature districts, and some of them (looking at you, Tengah) are so underdeveloped, National Geographic might pay you to look for lost tribes in the area.

An old flat, on the other hand, has more amenities nearby. It can mean living next to a legendary eatery, or minutes from bus stations, MRT stations, Sheng Siong, etc.

But there are some serious considerations that should be addressed; issues such as:

*So long as the lease will last until the youngest buyer is 95 years old

Let’s go over these slowly, shall we?

1. Your flat won’t be as much help to your retirement fund

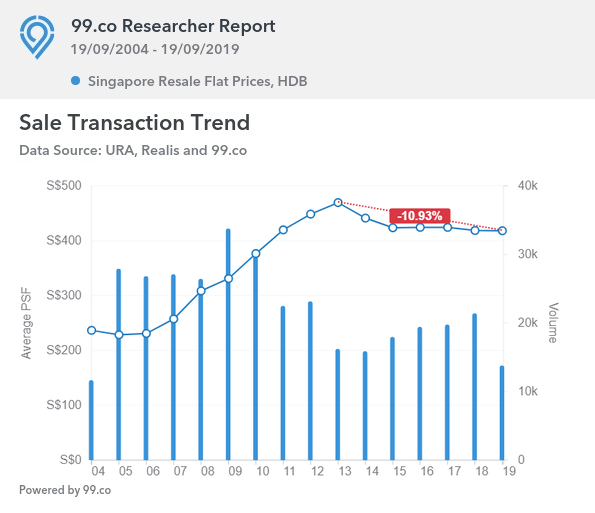

We’re long past the days when people would pay crazy prices for resale flats. Also, you can mostly forget about Cash Over Valuation (COV) these days. Sure, it still happens and there are occasional million-dollar flats; but for the most part, this is what resale flat prices are up to these days:

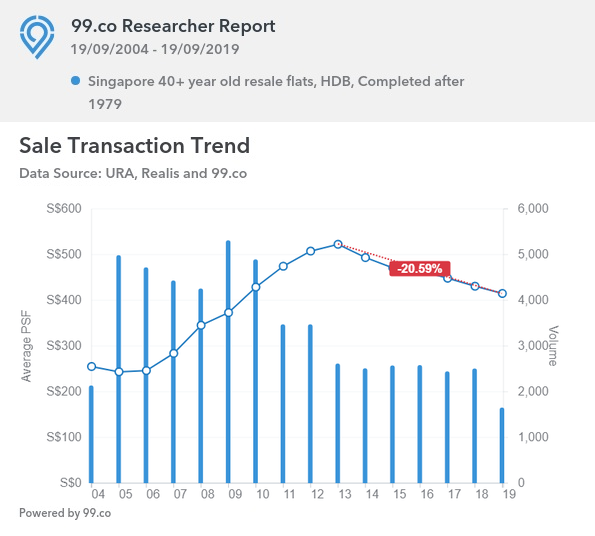

Just to be more specific, here’s what it looks like for flats completed in 1979 or earlier:

Even if you can resell a flat that was 40+ years old when you bought it, you shouldn’t expect it to help your retirement fund much. Singaporeans are just much more aware – and sensitive – about lease decay today. And unless you own a very rare type of flat – like a maisonette, or a unit with 1970’s kitchen decor that doesn’t make you vomit – you might see a capital loss.

So if you’re buying an old flat, don’t think of it as a future retirement fund. Look for alternative assets to fulfill that purpose. And treat the flat as a pure overhead – it’s a roof over your head and nothing more.

2. You can’t count on SERS and VERS

Only around five percent of estates will qualify for the Selective Enbloc Redevelopment Scheme (SERS). We wouldn’t count on it, unless your flat is in a particularly visible and iconic location.

If your flat is thew sort that appears on postcards and is visible from major roads, that’s a location that might be SERS-worthy. But if the flat is just tucked away in a quiet corner (i.e. the vast majority of them), then you probably won’t be a getting a new flat with a 99-year top-up.

As for the Voluntary Early Redevelopment Scheme (VERS), it hasn’t happened yet; but we know the payouts won’t be as generous as SERS. If its pegged to market value, that could mean returns are barely enough to buy another, smaller flat. And by the time you return the CPF money used, the pay out might be enough for maybe one char siew bao, if you agree to share.

It also takes 80 per cent consensus for VERS to happen. That’s hard enough to get in a condo, let alone in a property with as many owners as an HDB flat.

3. Those amenities may not last as long as your flat

If you’re going to risk buying an old flat for the amenities, make sure those amenities really matter. Having an MRT station or good school nearby counts; having a famous kolo mee stall nearby doesn’t.

Remember that even the oldest amenities can go the way of Chin Mee Chin Confectionery. In fact, we’d suggest that for any property – especially in older areas, which are typically targeted for redevelopment – you check the URA Master Plan.

Sometimes, even that doesn’t help.

In Tiong Bahru, for instance, the area suffered death by cappuccino. Gentrification replaced older amenities with upscale hipster amenities, which many of the older residents there can’t afford or have no interest in. Are you okay to replace your kolo mee with pumpkin-spiced avocado whatever? Because that may happen.

The older the area, the more likely it is that sweeping changes are due; if not organically, than through deliberate redevelopment. Factor in that risk, when buying such an old flat.

4. HIP or no HIP, maintenance is likely to be an issue

Our prior article addressed misconceptions about HIP. This isn’t a magic wand that HDB will point at your flat, and instantly erase month old stains in the flooring, or correct sagging toilet doors. HIP handles the essentials; everything else comes down to renovation and maintenance out of your old pocket.

That means you’re likely to spend much more on renovations, compared to an brand new BTO flat. And simple age causes issues that are elusive to fix – the wafting scent of ageing pipes in the toilet, the unusually low water pressure from a tap because of a leak…somewhere, the odd stains that keep appearing no matter how many times you patch them, etc.

Be prepared to spend more as your flat breaks down like an alcoholic’s liver.

5. You better have a plan in case you live too long

Based on all the insurance ads and CPF planning messages, we surmise that Singaporeans now have a lifespan than would shock a vampire. We do, after all, have the longest life expectancy in the world (yes, even longer than Japan. All that kolo mee must be good for the heart).

But in any case, do pause to think: what if your 40+ year-old flat turns out to have a shorter lifespan than you? It’s not as if you’re in a good position to sell it and move, in the twilight of your life. And should you outlive your flat at the age of, say, 80+, it’s rather difficult to find the funds for a new home at that point.

So before you buy that old flat, make sure it will last till the end of your life, or that you have a plan for when it doesn’t. And remember, moving to Thailand tends to sound a lot less appealing once you’re past 75.

5 days ago · 7 min read · Source: 99.co