HDB’s announcement of the latest changes to the much-maligned income ceiling is sure to elicit extreme reactions.

Those who were previously disqualified from BTOs for income reasons must be thanking their God of Fortune, whereas the unlucky couple who have waited donkey years for a successful BTO might just be about to give up entirely now that there’s even more competition for the coveted queue number.

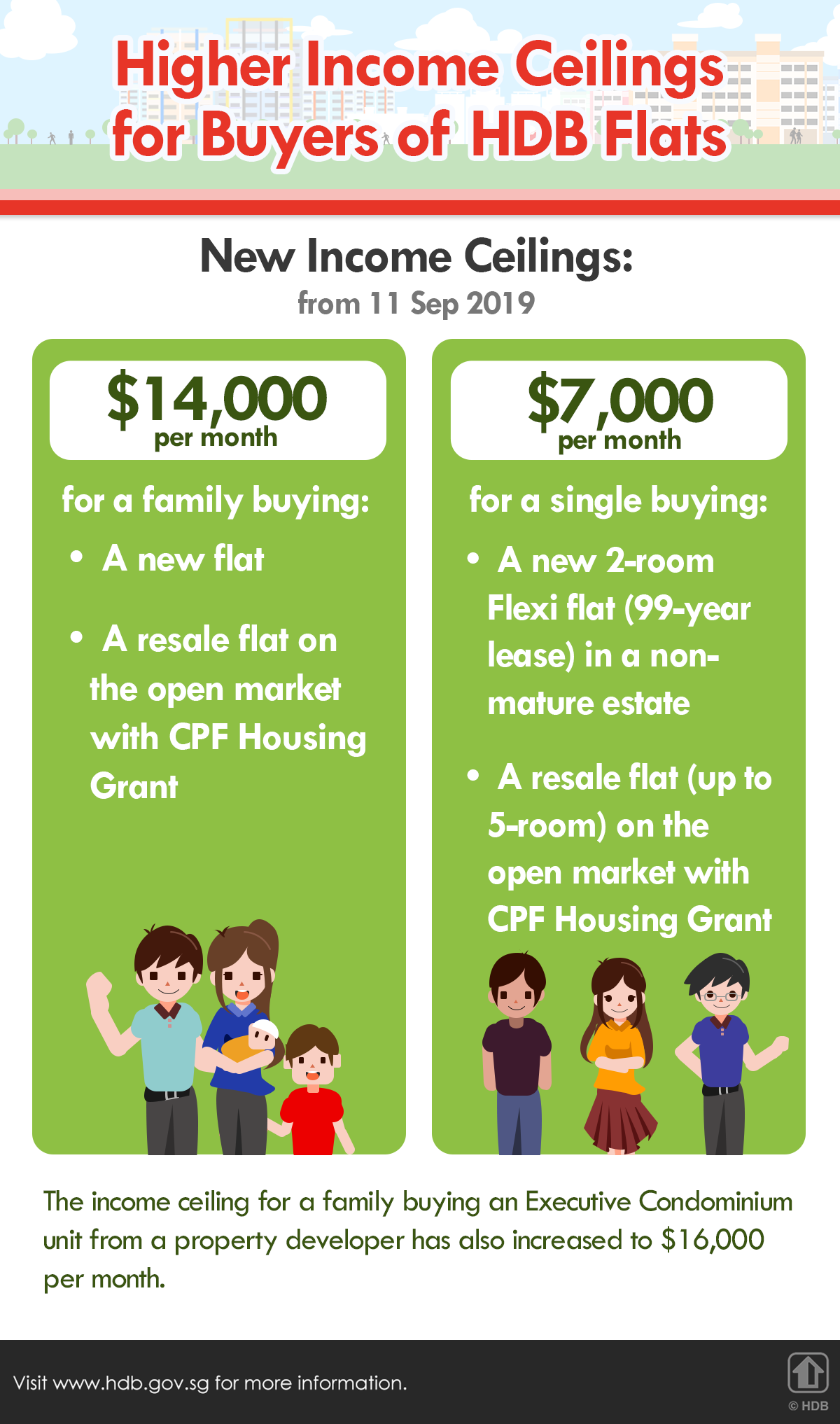

In any case, the change in income ceiling was going to come sooner or later. The last time HDB revised the ceiling was in 2015: a similar $2,000 increment from $10,000 to $12,000, and one could argue this latest change is somewhat overdue given that Singaporeans’ median incomes have risen significantly in recent years.

The Enhanced CPF Housing Grant (EHG)

The Enhanced CPF Housing Grant (EHG)

With the government combining two existing schemes – the Additional CPF Housing Grant (AHG) and the Special CPF Housing Grant (SHG) – to form the Enhanced CPF Housing Grant (EHG), the maximum salary eligible to apply has also been increased from $6,000 (AHG + SHG) to $9,000 (EHG).

The government has also made the new EHG grant available for the purchase of resale HDB flats (the SHG was previously available for buying BTO flats only).

The other significant change is that the EHG is extended to all flat types and locations. Previously, the SHG was available only for purchases of four-room or smaller new flats in non-mature estates.

While the actual effects of HDB’s changes remain to be seen, there are some observations that we can infer from the latest developments:

Observation #1: Are ECs now too atas?

Along with the BTO income ceiling increase, the government’s decision to raise the EC income ceiling from $14,000 to $16,000 could be partly influenced by recent prices Executive Condominiums (ECs). And by recent ECs we mean Piermont Grand, the first EC project launched in nearly two years.

Selling at a median price of $1,107 per square foot (psf), Piermont Grand could signal a new norm for EC launch prices. After all, in 2013, Punggol ECs Waterbay and Ecopolitan were sold at an average of just $729 and $793 psf respectively when it launched, prices that would be unthinkable in today’s context!

With the increased EC income ceiling it is clear that HDB expects Piermont Grand’s prices to be the new norm for Executive Condominiums.

At these prices, the government also knows that there would be more than a few buyers in the $12,000 to $14,000 bracket who would simply walk away. And with a number of upcoming EC projects in the pipeline, the last thing HDB would want is to create is a demand-supply mismatch that would hurt developers’ wallets and affect their bid prices for future EC plots.

Observation #2: A play to boost resale HDB flats?

At first glance, it might seem that the government is specifically opening up BTO flats to more Singaporeans by raising the income ceiling. But the restructuring of the grants can also be construed as another tactic in long line of efforts to boost the stagnating HDB resale market.

With increased competition for BTO units in future sales launches from the ‘$12,000-to-$14,000-income applicants’, this could finally be the straw that breaks the BTO hopeful’s back, pushing them to see buying a resale flat as the only feasible option.

Probably knowing that this is a tad too demoralising, the government has also increased the grant to resale buyers through the EHG. Better still, they have allowed the EHG to be pro-rated to the remaining lease of ageing flat*, as opposed to being overly strict or reluctant to disburse grants, as was the case previously.

*The EHG is applicable to households buying a flat with remaining lease that can cover the youngest buyer and spouse to the age of 95; otherwise, the household will enjoy a pro-rated EHG.

Observation #3: Is the EHG good for lower-income households?

With the announcement of the Enhanced Housing Grant (EHG), the biggest beneficiaries could be the less well-off in our society. This is true even though when compared to the combined AHG and SHG, the biggest possible grant amount under the EHG remains unchanged at a maximum of $80,000.

Here’s the explanation: To take advantage of this maximum grant amount previously in its AHG/SHG form, those seeking a home over their heads were limited to choosing BTO flats within non-mature estates. If they were to buy a resale flat, the maximum grant amount is automatically halved to $40,000.

Now, these home-seekers are able to choose from any type of flat in any location and enjoy the full $80,000 EHG grant. This is on top of possible grants such as the Family Grant (maximum $50,000) and Proximity Housing Grant (maximum $30,000) – an unprecedented $160,000 worth of assistance (the previous maximum was $120,000).

With resale flats becoming eligible for the full EHG grant amount, this means that many more lower-income families will be financially able to set up a home – an important part of personal security and well-being – in a quicker time frame than having to ballot and wait for a BTO flat to be built.

Also, with the EHG, many such families will be able to consider homes in the open resale market and also outside of non-mature estates, and we believe this may kickstart better integration between various income groups in society.

Having much greater choice and mobility means that lower-income households can take advantage of more job opportunities and choose to live nearer to their workplace, trading commute time for extra pay, for instance. Lastly, the EHG may also alleviate lacklustre demand for ageing – but cheap – flats in HDB estates by empowering more households with the ability to buy these flats.

Observation #4: A preparation for recession?

The revised income ceiling and grant changes could also be seen as the government trying to usher the middle-class into public housing, be it BTO or resale, and reducing their general financial burden at a time when the global economic situation is looking bleak.

After all, with a slowdown looming in the horizon, the last thing our government wants is for the sandwich class – those who have barely exceeded the previous income ceiling – to put all their eggs into a single basket called Private Condo Mortgage.

Source: 99.co (11 Sep 2019)