If your only concern is rental yield, then an HDB flat will come out ahead of a private property simply because a HDB flat costs less. Many HDB flat owners will tell you about yields as high as 5 to 7%, about two percentage points ahead of private properties. But is this accurate, and does it mean that every Singaporean should own a HDB flat for asset progression?

How high or low can HDB flat rental yields get?

We’ll use four-room HDB flats as a point of comparison, as these are by and large the most common size that Singapore homebuyers go for.

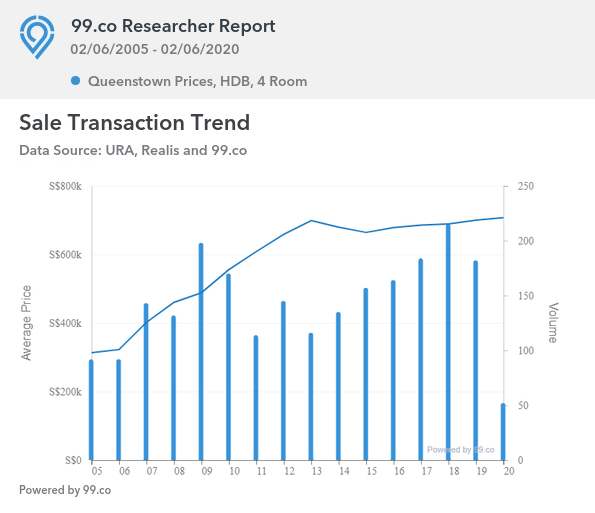

Queenstown has the most expensive four-room flats on average, at around $707,086. The rental income for Queenstown four-room flats averages $2,566 per month.

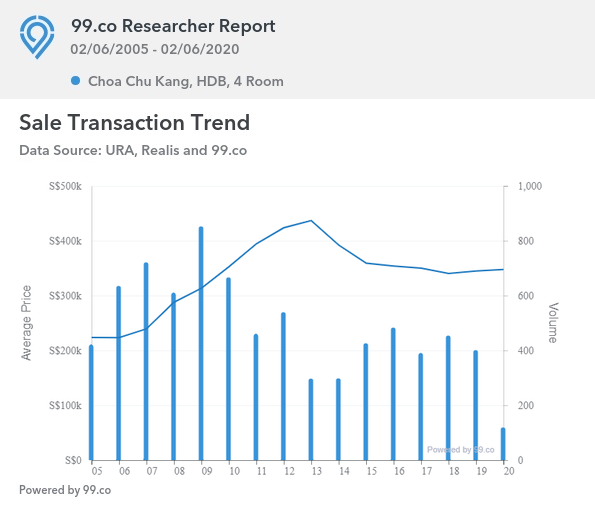

The lowest-priced HDB four-room flats generally come from Choa Chu Kang, at around $347,659:

The rental income for Choa Chu Kang is about $1,782 per month.

To derive the gross rental yield, we divide the annual rental income by the price of the flat, and multiply it by 100. In this case, the gross rental yield for Queenstown four-room flats is about 4.3%.

The rental yield for four-room flats in CCK is much higher, at 6.1%.

The difference is likely to be greater if you compare net rental yield

Don’t forget the conservancy fees for four-room flats are only around $72.50 a month, whereas it’s as high as $1,200 per quarter for most condos. Stamp duties are also higher for condos, as are additional costs such as renovations. When you factor these in, the net rental yield for condos can sometimes fall to below 2%.

Also, some condos have freehold status. These are priced at a premium of around 15-20%, but tenants don’t pay any more just because it’s freehold. With an additional premium for freehold condo units, rental yields for such properties are even lower.

Advertisement

Rental yield is high, but does this mean HDB flats are always a better investment than private properties?

While it makes sense for HDB upgraders to move to a newly-bought condo and retain their HDB flat for rental income. There are some things to bear in mind if you happen to view HDB flats as a pure play for investment:

#1. Condos have higher value appreciation than HDB flats

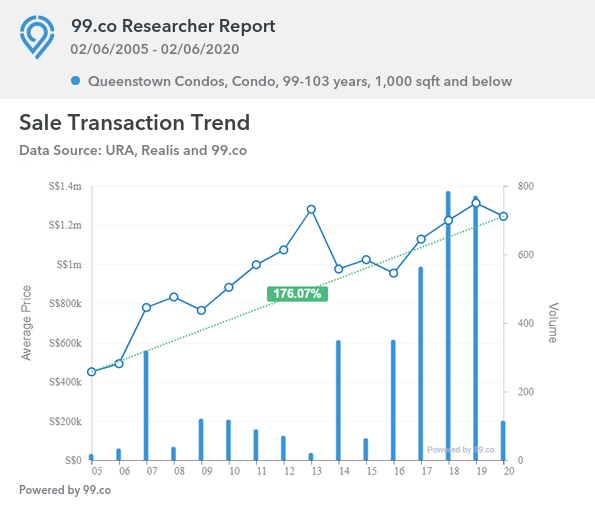

Rental yields, despite providing a steady stream of passive income, may pale in comparison to the actual appreciation in value of a property. Let’s take a look at the value appreciation for condos of up to 1,000 square feet (about the same size as a three-room flat) in Queenstown. We’ll also focus only on the 99-year leasehold condos, as HDB flats are also leasehold:

We can see that condo prices in this area have appreciated by over 176%, from around $450,700 in 2005, to about $1.244 million today. What about HDB four-room flats here?

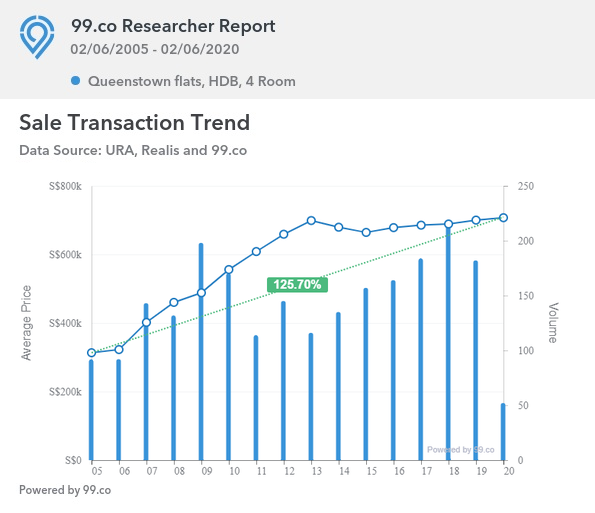

The four-room flats have actually appreciated quite well, from $313,258 in 2005 to $707.086 today. But this is still behind the private properties by around 50.5 percentage points.

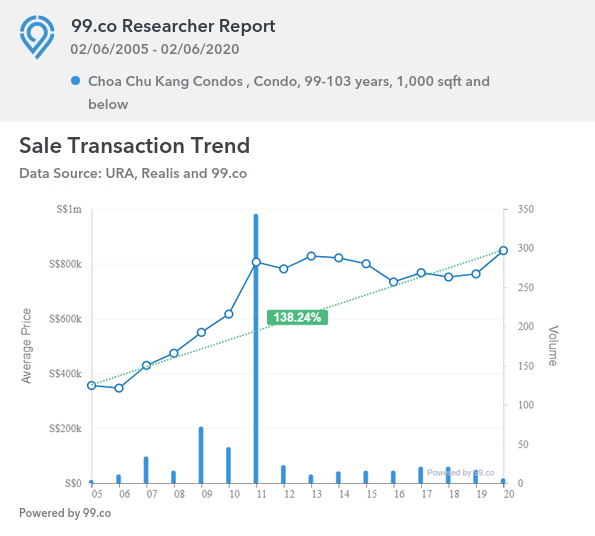

Let’s take a look the value appreciation for condos at the more affordably priced Choa Chu Kang:

Average condo prices here have risen about 138.2%, from $355,950 in 2005 to about $848,000 today.

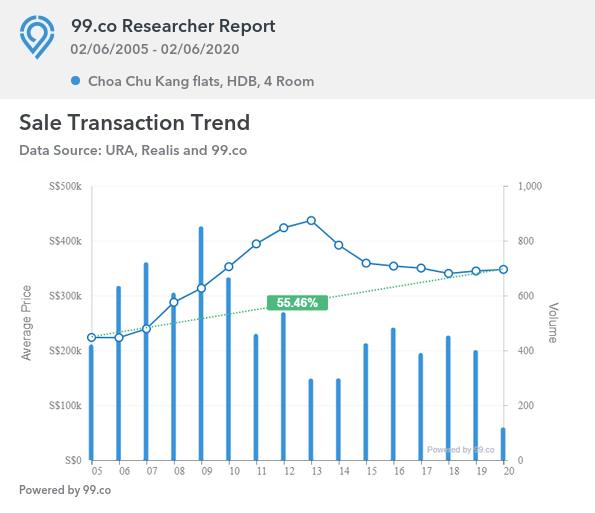

But four-room flats in the same town have risen at a much lower pace:

From $223,630 in 2005, to $347,659 today; that’s less than half the appreciation in value of private condos in the area.

Of course, no one can predict what the eventual resale price of your particular property will be. But, as a general rule of thumb, we can see that condos—even leasehold condos—have better appreciation prospects in general than HDB flats that outpace any differences in rental yield.

#2. There’s an MOP period

Don’t forget you can’t rent out the whole HDB flat (only individual rooms can be rented out) during the five-year Minimum Occupancy Period (MOP). This is five years of lost rental income. With a condo, you can start renting the moment the property is up and ready.

With resale condos, it’s even possible to buy a property that’s already tenanted, and start collecting rent right away. Five years of rental income can make up for the difference in rental yield alone.

Advertisement

#3. Lack of en-bloc potential

Only around five per cent of HDB estates will qualify for the Selective En-bloc Redevelopment Scheme (SERS). Most of them will have a chance only at the less generous Voluntary Early Redevelopment Scheme (VERS), of which we’ve yet to see a single exercise.

SERS is typically executed by HDB to increase housing density and improve the utilisation of space within older HDB estates. Unlike private developers, HDB doesn’t conduct an en bloc just because they stand to profit from redeveloping a cluster of flats, for instance.

Private developers, on the other hand, are always looking for opportunities to acquire older private properties, because they have an ongoing need to replenish their land bank and deliver profits with new projects. Hence, condos in general have a significantly higher en bloc potential.

And because a condo en bloc goes through a highest bidder tender system, the payout that owners get for giving up their property for redevelopment is much higher (on a per square foot basis) than HDB residents would get from the government in a SERS exercise.

The compensation to residents in an en bloc sale is even higher for freehold properties. Freehold condos can command better en-bloc prices as the developer doesn’t need to the government additional $$$ top up the lease.

Mind you, we’re not suggesting you gamble on the possibility of an en-bloc sale. But it’s that potential that you won’t find in an HDB flat.

#4. No cash-out refinancing

You can check out our previous article on this for more details. Cash-out refinancing is essentially a low-interest loan secured by using the property as collateral; an option not available for HDB flats. This can be more generous than schemes such as the Lease Buyback Scheme, which is one of the only solutions for HDB owners who are short on cash but need to keep their homes.

How can you capitalise on the high rental yield of HDB flats?

If your intention is to eventually buy a private property and then rent out the flat (after the five year Minimum Occupancy Period), one possible method is to buy the smallest and cheapest flat you can reasonably live in to start, while making sure that the flat (1) well-maintained, and (2) located in an area with high rental demand/tenant pool.

Later, anytime after the MOP, use your savings to help fund a private property purchase (remember that you need to pay the 12% Additional Buyers Stamp Duty). You can then rent out the flat for an optimal rental yield, and use the rental income to offset the mortgage and maintenance costs of your condo home.

To maximise the amount you can borrow for your second property, it’s prudent to clear your home loan on your HDB flat so you can pay just 25% of your condo’s price as downpayment. Otherwise, under Singapore’s loan-to-value (LTV) guidelines, a second home loan will require the buyer to fork out 45% of the purchase price as downpayment.

Some people move in with parents or in-laws for a few years after MOP, relying on the rental income to build savings, pay off their HDB loan and upgrade to a private property. (Make sure your parents are okay with this, of course!)

To calculate rental yield for an investment property, check out this article!

15 hours ago · 7 min read ·

Source: SRX (17 Sep 2020)

Advertisement