Singaporeans are a practical and savvy bunch. When it comes to selling our flats, most of us would prefer to receive the HDB sale proceeds in cold hard cash, rather than having it go into our Central Provident Fund (CPF) accounts. In this article, we’ll show you exactly how much of your property sale proceeds needs to be refunded back into your CPF account upon selling your flat.

Knowing the amount can help you plan your finances and decide whether to sell your flat or not. (Agent commission and the HDB resale levy are rather straightforward deductions from your sale proceeds, but refunding CPF needs more explanation.)

What you taketh from CPF, they must taketh back (from your HDB sale proceeds)

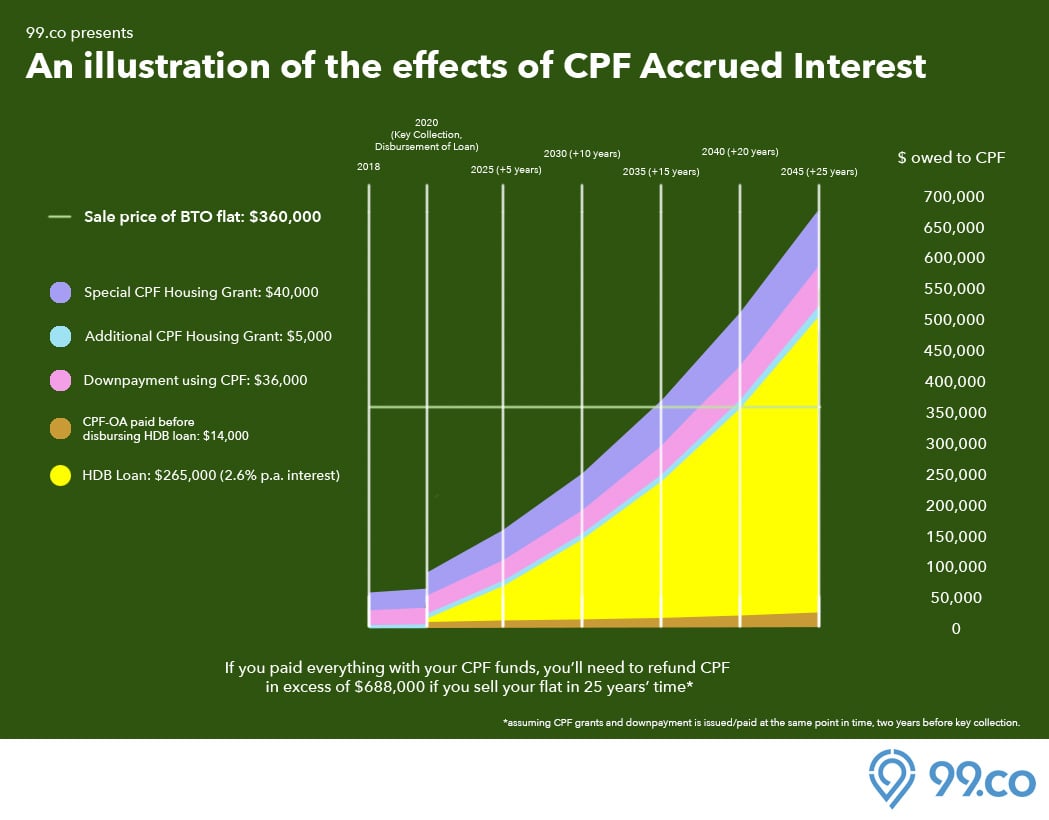

It is compulsory that any CPF funds used or received to finance a property must be repaid to your CPF account when the flat is sold. This repayment is made up of the principal amount used/received plus accrued interest. Accrued interest is the interest this amount of money the principal amount would have earned if it was sitting in your CPF Ordinary Account (CPF-OA) instead of having been taken out to pay for your flat. (Currently, the CPF-OA interest rate is 2.5%). Think of it as a reverse interest; the more the time passes, the higher the accrued interest you’ll have to pay back into your CPF-OA.*

Advertisement

Yes, most of us would need to do a double-take when first hearing about the accrued interest rules, but hey, the Singapore government really sees the value of CPF for our retirement…

*The reality of having to pay accrued interest on top of the interest you already pay for your mortgage is why some people choose to service their home loan installments in CASH, even if they can do so using their CPF.

You must return the principal amount + accrued interest of all the received CPF grants

Although the word “grant” sounds generous, there are strings attached when it comes to getting it from the CPF. If you apply for and receive a grant from CPF at any point of time to help pay for your HDB flat, you’re required to return that amount, plus accrued interest on that amount, when you sell your flat. We’ve heard a story of a flat seller who forgot they received a grant from CPF some years back, only to find that the cash proceeds from the sale of their flat got nearly wiped out because they needed to refund CPF the said grant plus accrued interest.

To illustrate how CPF grants could end up eating into your sale proceeds, a flat owner who took a $5,000 CPF grant in 1998 would owe CPF a total of $8354.44 on that grant in 2018. Another example: If you buy a resale HDB flat today and take a CPF Family Grant of $50,000 for your purchase, your principal plus accrued interest on this grant amount alone would be $107,991.81 after 30 years — more than double of the grant amount you originally took!

If it’s any consolation, if the amount you have to refund CPF exceeds your cash proceeds, CPF will write off the excess amount (i.e. you’ll not be required to refund CPF beyond the HDB sale proceeds you receive). But take note that this is only in the case when you sell at or above your property’s market value*.

Advertisement

Here’s the thing: If you sell below market value and the amount owed to CPF (plus accrued interest) exceeds your cash proceeds, you’ll have to return 100% what you owe CPF to your account by default, even if it means having to pay cash out of your own pocket. That said, sellers can appeal to the CPF Board to waive this ‘debt’, and have their cases assessed on a case-by-case basis.

So what should you do?

First, find out how much CPF can take from your HDB sale proceeds

To calculate how much money you “owe” CPF at a given point in time, log in to CPF Online Services using your Singpass, click ‘My Statement’ on the sidebar, and scroll down to Section C. Under the ‘Property’ tab, the principal amount you need to refund CPF is the ‘Net Amount Used’, while the accrued interest is under ‘Accrued Interest’. The sum total of ‘Net Amount Used’ and ‘Accrued Interest’ is what you need to return to your CPF account when you sell your property.

Advertisement

A step-by-step example to computing your HDB sale proceeds:

In order to figure out how much cash proceeds you’ll get from the sale of any given flat, you’ll need to know and factor in your sale amount, CPF principal amount, CPF accrued interest, HDB resale levy, agent commission fee, and legal fees. (For simplicity, the refundable option fee—from the buyer of your existing flat—has not been factored into the calculation.)

The illustrative example:

>Say you’re selling your 4-room HDB flat that you bought for $150,000 in 2001, with a $15,000 CPF grant and $15,000 downpayment from CPF-OA. All mortgage installments paid using CPF, with outstanding loan amount at $50,000.

(A) Sale amount = $550,000 (If you’re not sure what your property might sell for, refer to HDB’s past transacted prices)

(B) Outstanding loan amount = $50,000

(C) CPF principal amount used = $130,000 (consisting of $100,000 mortgage payments + interest paid using CPF and $30,000 grant plus downpayment)

(D) CPF accrued interest = $97,000 (this has been rounded off for easy calculation)

Note that (D) is calculated based on principal amount compounded yearly up till the point of sale, not until the end of the loan tenure.

(E) HDB resale levy = $40,000 for a 4-room flat, assuming you’re buying an EC or another flat directly from HDB (e.g. BTO or SBF)

(F) Sale proceeds = (A) – (B) – (C) – (D) – (E)

$550,000 – $50,000 – $40,000 – $130,000 – $97,000 = $233,000

**(You may also estimate your sale proceeds using HDB’s Sale Proceeds calculator)

(G) Agent commission fee = $5,885

This is typically 1 to 2% of the sale price, with GST (currently 7%) tacked on separately.

(H) Legal fees = $2,500

Generally, legal fees cost between $2,000 to $3,000.

Cash proceeds = (F) – (G) – (H)

$233,000 – $5,885 – $2,500 = $224,615, which may or may not be sufficient to finance your next home purchase and/or fulfill other objectives for selling the home.

IMPORTANT: For those who are aged 55 or above…

Assuming you’re 55 years old in 2020, your Full Retirement Sum will stand at $181,000. If the combined balances of your CPF-OA and Special Account fall below this threshold, the amount refunded to your CPF-OA from the sale of your flat will automatically go into your Retirement Account. This means you’ll no longer be able to tap on these funds for housing above a certain age!

Note that if you are still working, contributions to your CPF-OA can still be used to pay for your outstanding home loan. This is even if you don’t meet the Full Retirement Sum.

Also, if your CPF savings can exceed the Full Retirement Sum, the excess can be set aside to pay for your home loan.

The bottom line? Unfortunately, the vast majority of folks who pay for their homes with their CPF savings won’t be getting the cash proceeds they initially expect after they sell their HDB flat. The accrued interest that you must refund to CPF will really take a chunk your HDB sale proceeds, constraining your ability to upgrade or use the cash proceeds to start a business/pay for your child’s university education/set up a retirement fund*.

*Unless, of course, you plan to migrate after selling your flat, whereby you can withdraw your full CPF balance anyway.

Protip: Reduce accrued interest by making a cash refund to CPF

That said, there is a way of making sure that your sale proceeds don’t go to CPF upon selling your flat, or at least reduce this amount. Simply perform a cash refund to your CPF account (details in this link). This refund can be done either partially, or in full.

Subsequently, use cash as much as possible to pay your home loan installments for the remainer of your tenure.

Note that you’ve only got enough to make a partial refund (either a partial principal amount, or the full principal amount without accrued interest), then your accrued interest will still snowball, but at a slower rate. You’ll still have to put money back into your CPF account after selling your flat, but the amount would be lower.

In short, if you’ve got enough cash on your hands to make a full cash refund (principal + accrued interest) and pay off your home loan from then on, you won’t have to put any money back into your CPF account after selling your flat.

Advertisement

Other ways to lower CPF accrued interest (and possibly increase the cash you’d receive from your HDB sale proceeds in the future)

6 days ago · 9 min read ·

Source: 99.co (25 Sep 2020)

Advertisement