|

| “And if we live without furniture or appliances for the next five years, we can buy a CCR condo.” |

Sales of newer HDB flats hit a nine-year high last year

In 2019, there were 22,477 resale flat transactions. About 20 per cent of these transactions (4,578 units) involved newer flats (that is, flats 10 years old or younger). That’s the highest volume of newer flat transactions in nine years.

For comparison, go back about five years (to around 2014 to 2015); at the time, newer flats made up less than eight per cent of resale transactions.

Many (but not all) of these sales typically come from owners who have reached their Minimum Occupancy Period (MOP) of five years; they tend sell upon MOP – or slightly beyond – to upgrade to a private condo. While it’s not an unusual approach, what’s significant is the number of flat owners who are quick to do it these days.

Advertisement

Why is it happening?

A number of reasons such as:

1. Private housing, not flats, are increasingly seen as a “retirement plan”

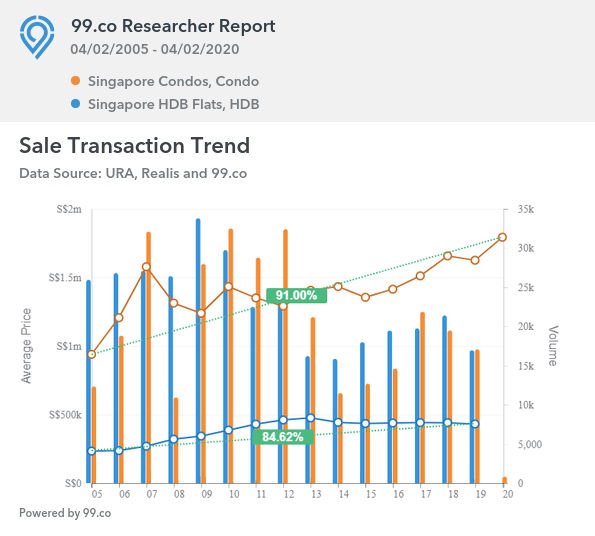

Take a look at the appreciation of condos versus HDB flats, over the past 15 years:

Over the past 15 years, flat prices have appreciated from an average of $233,520 to $431,118 (up around 84.6 per cent, annualised returns of about 4.17 per cent).

In contrast, private condos (excluding Executive Condos) have appreciated from around $938,740 to $1,792,974 (up 91 per cent, annualised returns of about 4.41 per cent).

Apart from condos appreciating better (a fact that probably surprises zero per cent of anyone), notice how flat prices have mainly trended downward or remained flat since 2013. On the other hand, condo prices are still generally climbing.

A lot of this is due to the perspective shift on HDB flats; the emphasis is now on flats as a form of “pure” home ownership, rather than investment. That’s not to say a flat can’t make you money – it just means that, with some exceptions, a flat probably won’t make you as much money as a condo.

The general perspective is that someone who quickly trades up to a condo will have a much a better appreciating asset than a flat; and when you take into account resale gains, condo owners will come out on top. As such, more flat owners want to upgrade as soon as they can (besides, it’s easier to sell a flat for a good price when the remaining lease is still nice and fresh, and the walls haven’t yellowed to the shade of grandma’s teeth).

2. Inherited wealth from previous decades of property appreciation

You know what the biggest hurdle in buying a condo is?

If you say “income”, you’re wrong. A dual-income family, with both spouses earning around $4,000 a month (average for Singaporeans), can usually borrow close to $1 million for housing*. If we just go by income, a surprising number of “typical” Singaporeans can qualify for condo loan, even without help.

The true hurdle to buying a condo is the down payment. This is currently at a minimum of 25 per cent, so a mass market, million-dollar condo means a whopping $250,000 down payment.

But this hurdle is easier to cross with the help of parents, many of whom have benefited from decades of high property appreciation. If you had bought a four-room flat in the 1970’s (around $20,000 at the time), you would have seen annualised returns of up to 6.3 per cent today, well outpacing inflation; and your property would have appreciated by around 2,050 per cent, to $430,000 today.

Add in other things such as savings, endowment plans, other investments, etc., and most parents are in a position to cover the down payment for their children. It’s also not uncommon for some parents to sell their flat, and share ownership of a big condo unit with the children (they expect to move in together).

That last one isn’t a good idea; but what can we do? MAS can impose all the loan curbs it wants on DBS; it can’t impose measures on the Bank of Mum and Dad.

*Based on a 30 year loan tenure, and assuming they get the maximum Loan to Value ratio.

Advertisement

3. Higher income and aspirations

Fortunately, Singapore is the meritocracy at the end of history where everyone is upwardly mobile, can upgrade their skill sets and suddenly become relevant with just $500, and only work after retirement (e.g. collecting cardboard) for the exercise.

As such, Singaporeans of the current and subsequent generations are likely to have higher income, and higher aspirations to go with it.

On a more specific note, Singaporeans have also become more better informed on how the property market works; prices for each neighbourhood, gains, yields, etc. and other data are more transparent than before. More of them are aware of the eventual outcomes of sticking with a flat, versus being able to upgrade; as such, more are rushing toward private housing as soon as they can.

4. Cash-out refinancing

There are ways to unlock value from an HDB flat, such as lease buy-back schemes. But these aren’t popular and fade in comparison to an option that private property offers: cash-out refinancing.

This is when a property owner uses a private property as collateral for a loan. They can borrow up to 80 per cent of the appreciated value of a property, at extremely low interest rate of around 1.6 per cent per annum. For comparison, the HDB loan interest rate is 2.6 per cent.

Even if a current owner cannot get such a loan (due to age or retirement), the children inheriting a private property may be able to do so.

This option isn’t available for public housing, and provides a massive advantage to some private home owners.

Expect this trend to continue

24,000 flats are expected to reach their MOP this year; and 2022 is expected to see some 31,000 flats reaching MOP. With fewer Singaporeans willing to rely on their flats for long term gains and retirement funds, there’s likely to be a continued trend in upgrading ASAP.

Would you upgrade right after your MOP? Voice your thoughts in our comments section or on our Facebook community page.

Looking for a property? Find the home of your dreams today on Singapore’s largest property portal 99.co! You can also access a wide range of tools to calculate your down payments and loan repayments, to make an informed purchase.

1 week ago · 6 min read · Source: 99.co (12 Feb 2020)

Advertisement