Congratulations! After years of hoarding money like a dragon in a high level D&D dungeon, you’re now sitting on a pile of wealth and wondering: is it time to put it to work buying a property, or just leave it in the safe hands of CPF? Here’s what to know before you decide:

Necessary caveat:

A property investment can indeed go like clockwork. If by clockwork you mean it has more springs, gears, and sensitive moving parts than most of your internal organs. What you read here is generalised and simplified; it can never, and will never, hold true for every property investment.

Consult a qualified professional on the appropriateness of property assets in your portfolio. As to who’s a qualified professional, it depends on which side wins the flame war when you ask that question.

Advertisement

First, let’s look at a typical condo over the past 15 years

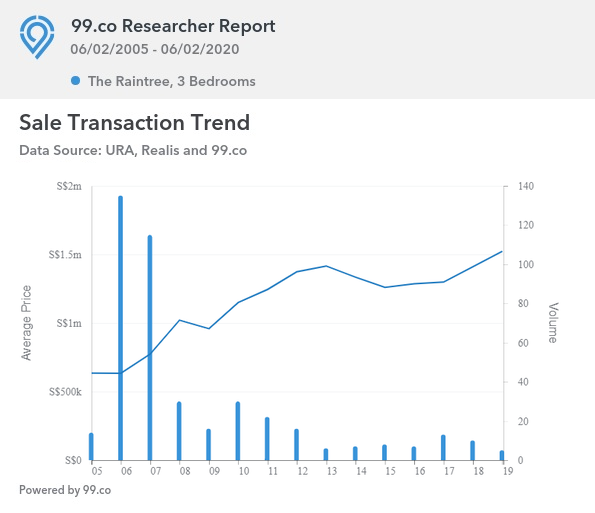

As our example, let’s look at at the price of a three-room unit at The Raintree. This is a leasehold, medium sized (315 unit) development in Bukit Timah. It received its TOP in 2008, and is pretty typical of the units people bought for investment back in ’05.

If you have bought this in 2005, the price would have been around $634,400. Yeah, a condo in Bukit Timah used to be cheaper than some resale flats today; you sure missed out (that’s what you get for not being born earlier).

But let’s look at what you really would have paid overall:

Note that there was no Additional Buyers Stamp Duty (ABSD) at the time, if it had been your second property.

Miscellaneous costs will include legal fees, home insurance policies, agent commissions for finding new tenants (one months’ rent for one year of lease, so assume you pay this 12 times from 2008 to present), home repairs, occasional vacancies, and others. A reasonable estimate is about $55,000 over 15 years, assuming no serious disasters.

Roughly speaking, the amount you would have sunk into this property, over 15 years, is about$959,566.

Advertisement

But if you were to sell that property at an average price today, you’d net around $1,523,000.

On top of that, let’s assume you got 11 years worth of rental income, between 2008 and today (there may have been a few vacancies in between). That’s an added $448,800.

So you sunk approximately $959,566 into the property, and got a total of about $1,941,340 out of it over 15 years.* That’s an annualised return of about 4.8 per cent, coming out ahead of your CPF’s 2.5 per cent.

*Deduct $30,460 to cover the sales commission of the agent, which is usually two per cent of the sale price.

If you did leave $926,450 in your CPF to grow at 2.5 per cent, you would end up with roughly $1.4 million.

However, there are three important factors to note

The first thing to note is that you won’t see such rosy results if you had bought after ABSD was implemented. Today, ABSD on the second property is 12 per cent for Singapore citizens. BSD is also higher, although there’s only a difference on properties valued at $1 million or more.

Combined with slightly higher property taxes, and a lower rate or price appreciation, it’s entirely possible that you’ll see lower returns than your CPF for some properties.

Second, the above example assumes you are fully renting out the property. If you’re just staying in the property and not generating rental income, the returns will be much lower. We’re also making an assumption of steady rental income – long periods of vacancy, or a plunge in the rental market, can sent your returns plummeting.

The third and final factor is the timing of the sale. You can see from the graph above that, had you held for 10 years and sold, the average price you would have got was only around $1.26 million – a whopping $263,000 difference.

Advertisement

As such, we can conclude that a private property investment can beat your CPF only under certain conditions:

Ultimately, you have to decide if chasing a potential extra percentage point (compared to the risk-free CPF) is worth it. The list above isn’t an easy one – few of those things can be guaranteed. But some of you can’t sleep thinking of your money “rotting away” in CPF, or simply don’t trust it. In which case, it might be time to consider playing landlord.

Would you buy a property or just rely on your CPF to grow your funds? Voice your thoughts in our comments section or on our Facebook community page.

Looking for a property? Find the home of your dreams today on Singapore’s largest property portal 99.co! You can also access a wide range of tools to calculate your down payments and loan repayments, to make an informed purchase.

5 days ago · 6 min read · Source: 99.co (11 feb 2020)

Advertisement