At some point, Singaporeans will be putting in plans to upgrade – whether it’s from a flat to a condo, or a condo to a bigger condo or even a landed home. In any case, upgrading your property is a big move that can lead to a lot of financial missteps, so take note of some key precautions.

–

As this is a relevant topic, in the spirit of our upcoming Singapore Property Show 2021, sign up for our webinars at the upcoming Singapore Property Show 2021 (May 22, 23 and 29, 30) here.

–

1. Not setting aside funds for unexpected delays

Whether you’re upgrading a new condo or a resale property, you still need to brace for the possibility of delays.

There are cases where developers take longer than expected to finish a unit — the most extreme cases to date being Sycamore Tree and Laurel Tree. The condos were expected to TOP in 2016, but were uncompleted in the end as the developer went bust. In more recent times, housing construction projects have been facing delays due to the pandemic.

Even for resale units, there can be delays. Your interior design firm may run into subcontractor issues. Or you may find the previous residents left so much junk you need another few days to clear it out (this has happened on occasion when the previous residents were hoarders).

Whatever the case, never assume you’ll be able to smoothly move in on your completion date. Always have some cash set aside, for at least three months of temporary accommodations.

Even if you get lucky and don’t have to use it, you should set the money aside as an emergency fund to service your mortgage during a crisis.

2. Not bothering to understand the difference when switching from HDB loans to bank loans

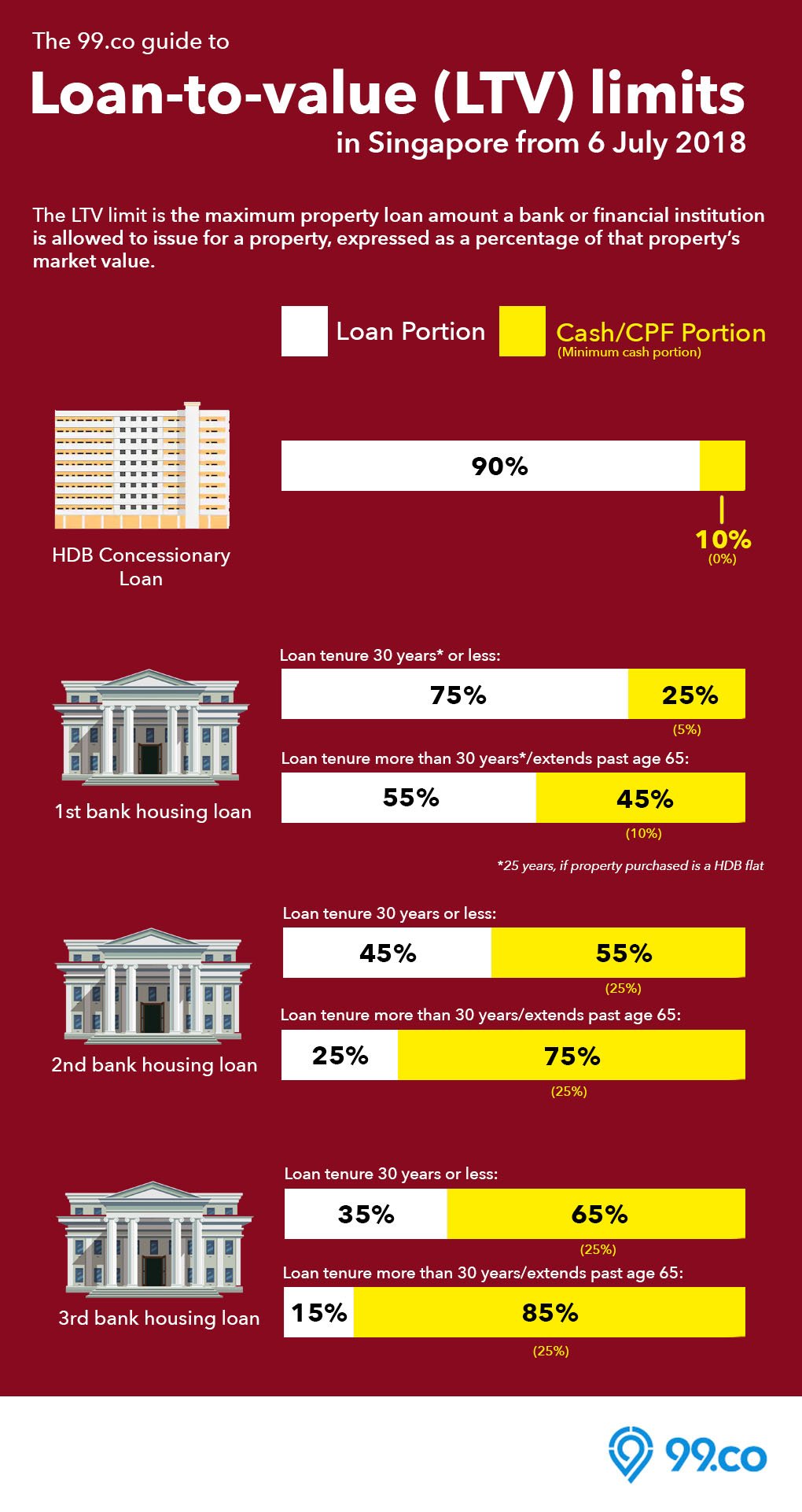

If you’re upgrading to an Executive Condo (EC) or other private property, you’ll have to use a bank loan. The key difference to note is that the loan-to-value (LTV) ratio is much lower compared to the HDB loan you may have been using previously.

Your HDB loan can lend you up to 90% of your flat’s value, and the remaining 10% can come from CPF. When it comes to the purchase price, it’s possible to pay nothing out of pocket when using HDB loans.

Bank loans, however, can only finance up to 75% of a property (assuming it will be your only outstanding property loan – otherwise it falls to 55%). For the 25% down payment, a minimum of 5% must be in cash, and the remaining 20% can be in a combination of cash or CPF.

Remember to work out the overall impact on your finances. A S$1.2 million condo means an absolute minimum of S$60,000 in cash (5%). So you may want to beef up your savings before going through with the deal.

Another thing to note is that, unlike your old HDB loan, bank loan interest rates fluctuate a lot more. Most typical bank loans are cheap for the first three years, and then jump significantly on the fourth year onwards.

Right now, a typical bank loan rate is around 1.5%, cheaper than an HDB loan’s 2.6% interest rate. But interest rates are rising as the economy recovers. So, bank home loan interest rates may even be higher than HDB loans in a few years.

A changing interest rate can mean that your loan repayments change every three months or every month, depending on your loan package. Make sure you talk it through with a mortgage broker, and plan for the fluctuations. One common mistake among upgraders is failing to understand how the loan interest is charged, and how to refinance it when it gets too high.

Advertisement

3. Really pushing the time limit on ABSD remission

If you buy your new home before selling your old one, you still have to pay the Additional Buyer’s Stamp Duty (ABSD). This needs to be done within two weeks of exercising the Option to Purchase (OTP).

However, a married couple with at least one Singapore Citizen can apply for ABSD remission. This is on the condition that your previous property is sold within six months of buying the new one.

Some upgraders push the time limit for all six months, trying to get a better price for their old home. But think twice before doing this.

Remember that even if the most last-minute buyer puts down an option just before the deadline, they may back out of the sale later. This can cause you to lose your ABSD remission. Whilst that means the buyer will forfeit their option fee to you, it still won’t cover the loss of your ABSD, which is an eye-popping 12% of property value for Singapore citizens.

The important lesson is: Don’t take your time selling your old home if you need the ABSD money to make your upgrading financially sustainable.

[Recommended article: How property buyers should react to the ABSD increase]

Advertisement

4. Taking big loans before upgrading

Remember that you need to meet the Total Debt Servicing Ratio (TDSR) when applying for your new home loan. The TDSR restricts your total debt repayments – inclusive of the new home loan, your personal loans, car loans and any outstanding home loans – to 60% of your monthly income.

Failing to meet the TDSR means you might have to fork out a larger down payment, or you’ll be unable to afford the house you want. So be sure not to rack up large debts in the 12 months prior to your upgrading attempt, or clear as many outstanding debts to the best of your ability.

In addition to the TDSR, note that banks will check your credit score when you apply for a home loan. Taking out large loans in a short time can mark you as being credit hungry, which will lower your credit rating. This can also result in the bank giving you less than the maximum LTV.

5. Selling your house, and then giving your children the proceeds to buy a big condo so you can move in with them

On the surface, it looks like you’re getting a two-for-one deal. You provide for your children while upgrading from your flat. But we’ve mentioned time and again that this is a terrible, unsafe idea – especially if you’re a retiree or approaching retirement.

Never assume that you’ll be able to move in with your children or in-laws, and get along perfectly. What will you do if your children try to kick you out of the condo, or if the shared space becomes unbearable? This is a disturbingly common problem in Singapore.

Plus, now that more people are working from home, you and your children may need more space. So sharing the house may not be as conducive.

If you have the means to leave and buy your own house when things don’t work out, then it may be safe to go ahead (although it often means strained relationships and a financial loss for you). But otherwise, just don’t do it.

So, am I ready to upgrade?

To answer this question, we propose the following guidelines to follow. As a rule of thumb, we recommend that:

That said, while it’s possible to upgrade and buy a condo even if you don’t meet any of the above, it’s the financial equivalent of walking a tightrope without a safety net below.

Just about any emergency, from retrenchment to lawsuits to serious illness, could result in having to sell the property and downgrade again. Doing so may net you a substantial loss if you need to sell in a hurry.

Even if you can get the same price or slightly higher than what you paid for the purchase price, costs such as the Seller’s Stamp Duty (SSD) can significantly dent your sale proceeds. Also, what you took out of your CPF account must be returned with accrued interest.

With so many potential pitfalls, remember this: If your desired home would take you beyond the above limits, consider a nearby alternative that’s more affordable. Use 99.co’s array of search features and you can easily find an upgrade that’s within your budget.

4 weeks ago · 9 min read ·

Source: 99.co (09 Jun 2021)

Advertisement