In November 2020, another 13 HDB flats were transacted in the resale market for a price of $1 million and above—taking the number of million-dollar flats sold in the calendar year to an all-time high of 73 with a month left to go. (The previous high was 72 flats in 2018.)

Advertisement

Notably, we are seeing HDB flats further away from the city centre clock million-dollar transactions. Ang Mo Kio notched its first and second million-dollar HDB transaction this year, whereas Clementi saw four million-dollar transactions this year alone, compared to five from 2016 to 2019.

Million-dollar HDB flats in more towns fits “rising resale price” narrative

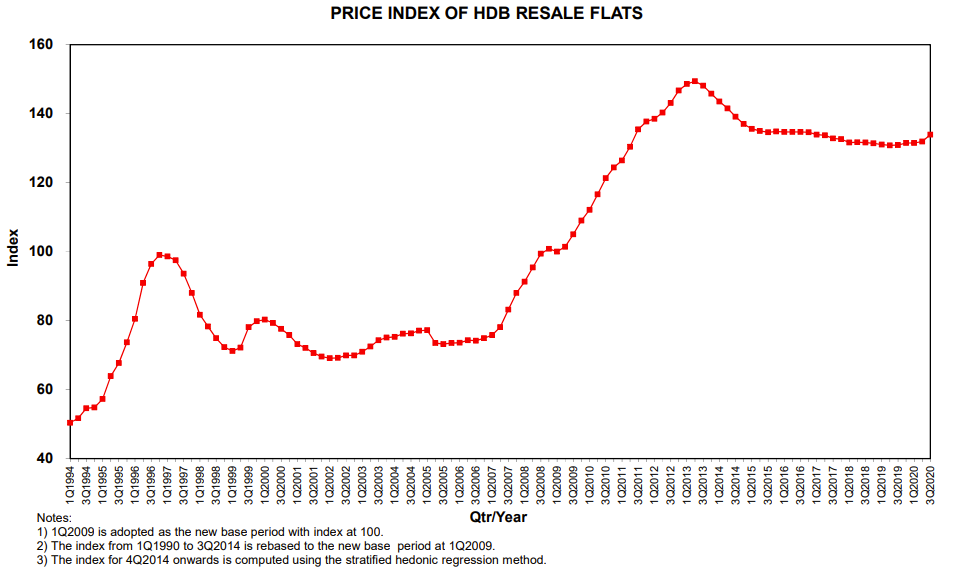

The abundance of million-dollar transactions coincides with an apparent rebound of the HDB resale market, which has been one of the key narratives in the property market this year after years of being in a slump according to the official HDB Resale Price Index (RPI).

In Q3 2020, the RPI registered its largest quarterly increase in nearly eight years, rising 1.5%.

According to the HDB, the RPI is “calculated using resale transactions across towns, flat types, and models.” If the index increases by 1.5% in that quarter, HDB’s logic is that on the whole, prices increased by about 1.5% over that quarter.

Whoa, wait a minute. It wasn’t long ago (2018, to be exact) that our government’s comments had caused public debate about HDB lease decay and declining resale value. It turned out that many Singaporeans had thought the government would bail them out of ageing, 99-year leasehold HDB flats with the Selective En Bloc Redevelopment Scheme (SERS).

Amid the commotion, the government came up with additional proposed measures to “cushion” the depreciation of ageing flats in that year’s National Day Rally. These measures, such as VERS, haven’t been launched yet, but many Singaporean HDB flat owners seem to have gotten well over the initial ‘panic mode’ about their HDB assets.

Why have they calmed down? It could be because, unlike in 2018 when the RPI fell by 1%, the performance of the index this year generated a media narrative that everything’s rosy again on the whole.

Is that the truth, or just a version of it? By looking deeper into data, we discovered that reality is more complex than what the index presents us with. Furthermore, it’s those HDB towns that recently joined the ‘million-dollar club’ that might provide the most worrying picture of the HDB resale price situation.

Advertisement

Ang Mo Kio: Resale values distorted by newer HDB flats

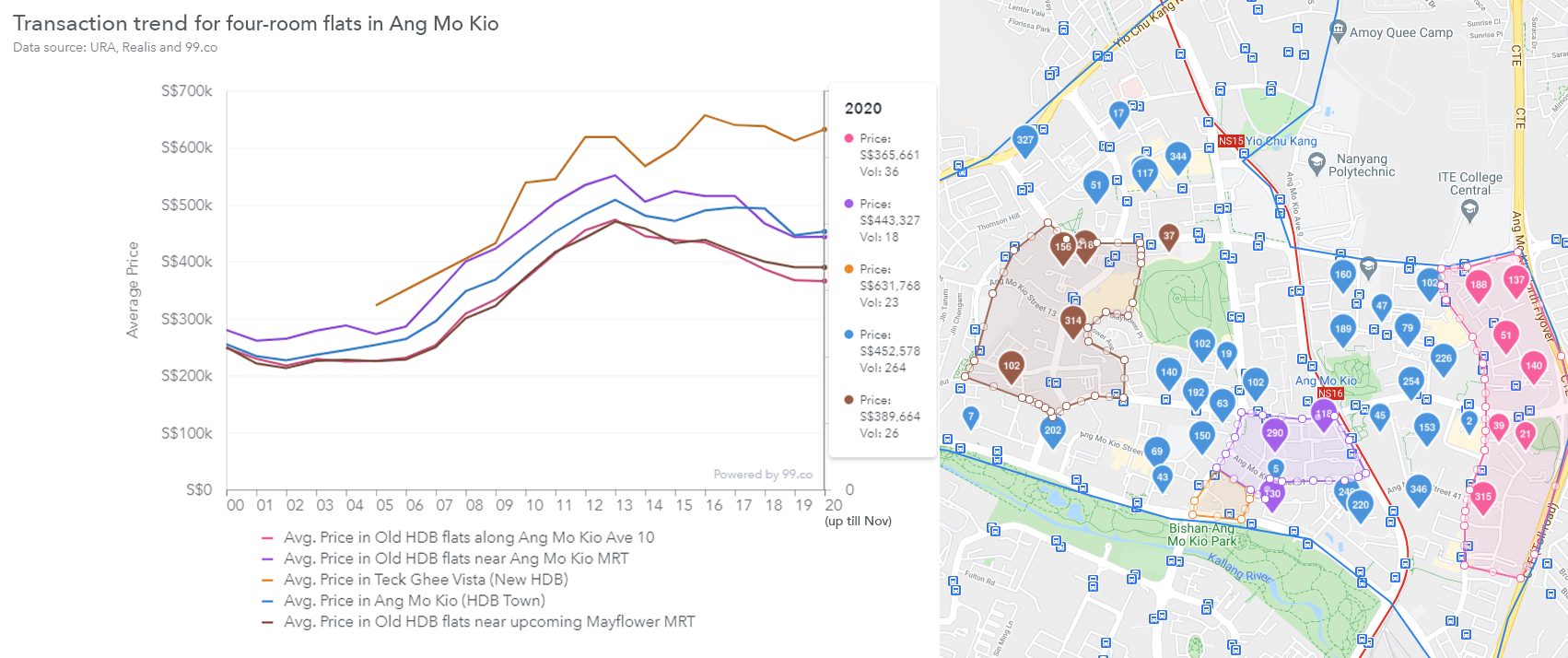

To analyse HDB resale prices in Ang Mo Kio, we singled out the following four different areas in the town:

Let’s look at the price performance of four-room flat types in each of these areas in Ang Mo Kio:

A lot is obvious at first glance. As Teck Ghee Vista, where a unit changed hands for nearly $1.09 million in November 2020, resale prices are on an uptrend.

But the story is different for the older flats in Ang Mo Kio. Even flats that are better located than Teck Ghee Vista, the ‘Old HDB flats near Ang Mo Kio MRT’ (in purple), haven’t been spared from what’s likely to be the effects of lease decay.

From 2013 up until the end of November in 2020, as average four-room flat prices in Teck Ghee Vista increased by 2.2% (from $618,500 to $631,768), average prices of old flats near Ang Mo Kio MRT fell a staggering 19.6%, from $551,174 to $443,327!

In this time, the overall HDB Resale Price index had fell by about 10%, hinting that any negative change in HDB resale prices may be “cushioned” by the robust prices for newer resale flats.

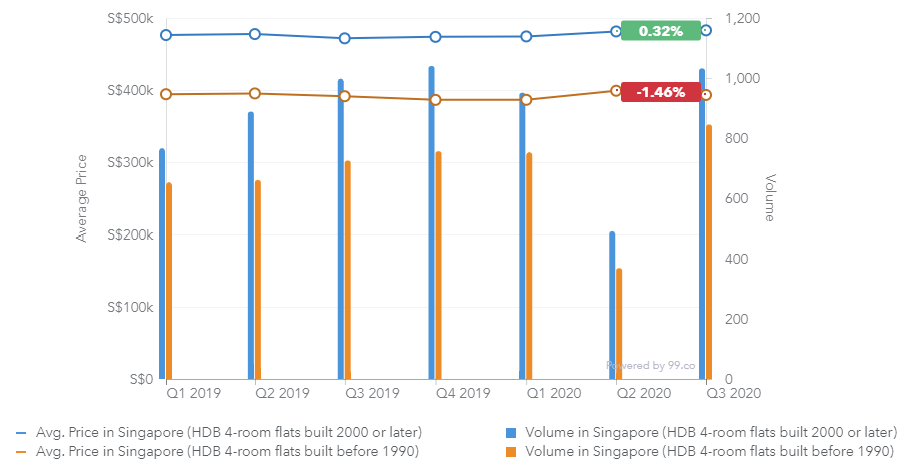

To prove the point, even as the RPI reported a 1.5% increase in resale prices in Q3 2020, we can see that the average transaction prices of older four-room flats in Singapore declined by 1.46% instead:

It’s also highly revealing that, despite there being about three times more number of flats built before 1990 than flats built on or after 2000, resale volume for the latter continues to outpace the former, indicating that Singaporeans much prefer newer flats to older ones. This preference and the resulting differences in demand could further exert downward pressure on prices of older flats.

Advertisement

For Ang Mo Kio, there could be silver lining for residents living in older flats near the upcoming Mayflower MRT station. The opening of the new station could help shore up declining resale value (prices in this area has remained flat in the first three quarters of 2020).

However, the same can’t be said about the older flats along Ang Mo Kio Avenue 10. Previously fetching the same average price as the flats near the upcoming Mayflower MRT, the lack of an MRT station has caused prices here to sink below the Mayflower flats.

And, as you can see from the Ang Mo Kio chart, the resale transaction prices for the newer flats in the town distorts the average (the blue line), making it seem like average resale prices for the estate are ticking up when, in fact, many older flats are going in the opposite direction.

So, instead of putting attention on how Ang Mo Kio is entering the big million-dollar league of resale flats, we should rightly be more concerned about the outlook of older flats in the town as they barrel towards the latter half of their remaining leases.

Clementi: New resale HDB flat values rise at the expense of older flats

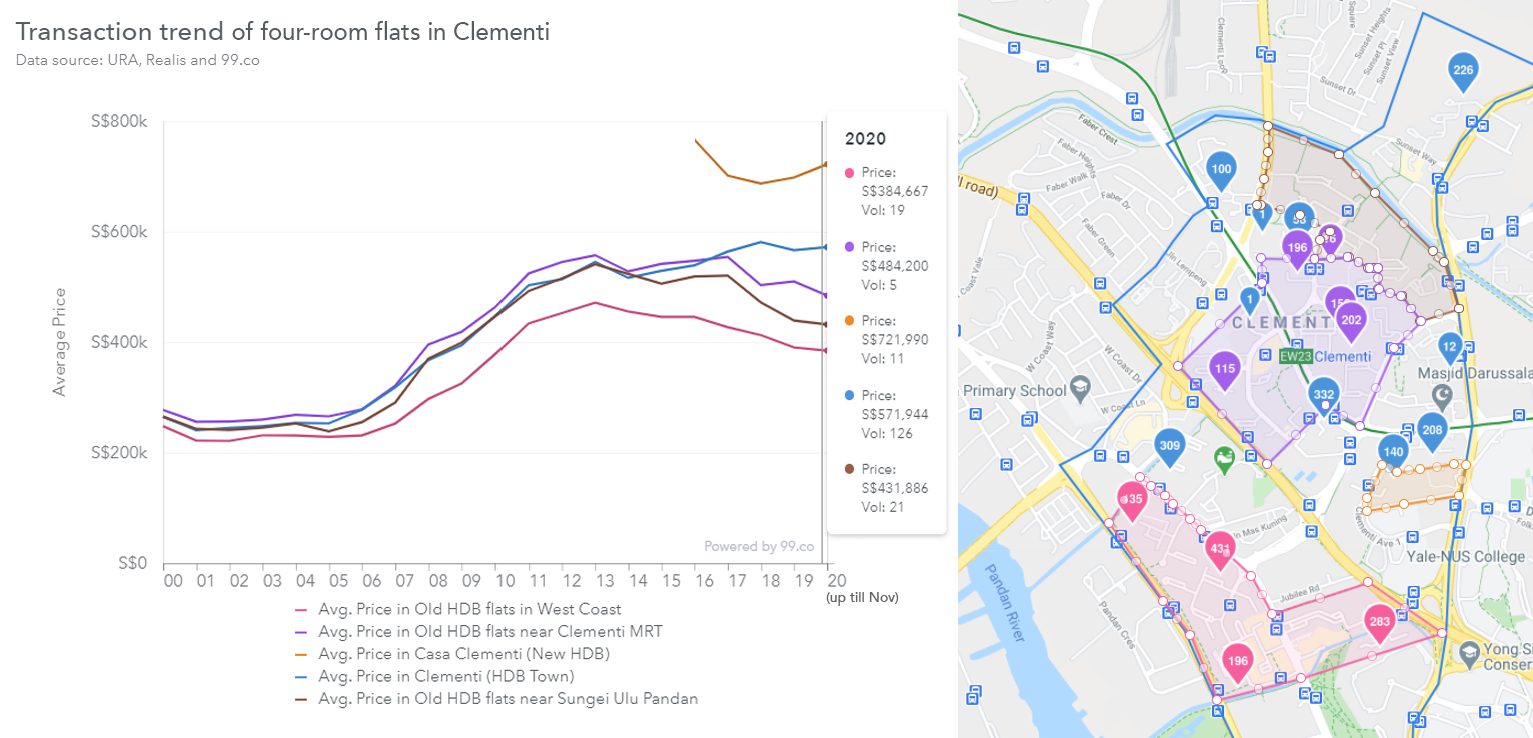

In Clementi, where four HDB flats have transacted at or above the million-dollar mark this year, it’s very much the same story. Here are the four areas in the town that we singled out for comparison:

Let’s look at the price performance of four-room flat types in each of these areas in Clementi:

The 2,234-unit Casa Clementi, a SERS project, was the town’s first new HDB development since the early 2000s. The year 2017, when owners of Casa Clementi began selling their flats in the open market after their Minimum Occupation Period, we saw prices for all the other areas begin to fall.

While average transaction prices for four-room flats at Casa Clementi have seen a 5.1% uptrend from 2018, prices for ‘Old HDB flats near Clementi MRT’ fell by 3.8% in the same period.

Prices for the cluster of flats in the north of Clementi, ‘Old HDB flats along Sungei Ulu Pandan’, fared even worse, falling by nearly 8.5% in the span of 23 months. Meanwhile, prices for old four-room flats in the West Coast area of Clementi fell by about 6.75%.

2018 was also the year that average resale prices in Clementi became distorted, showing the flat-ish trend that did not convey how older resale flat prices continued falling.

Advertisement

It is also worth noting that HDB launched more than 1,600 new Build-to-Order (BTO) flats in Clementi in 2017—a move that could possibly explain the price falls across the board. That year alone, prices for old flats near Clementi MRT fell by 9.2%.

Taller HDB blocks also distorting resale prices

Higher floor units fetch higher prices. And the arrival of super high-rise flats going up to 30 and 40 storeys in recent years could be amplifying the distortion of prices in the resale market overall, seeing as most older flats are only 10 to 15 storeys in height.

In fact, our data shows that in projects that have had multiple million-dollar transactions, none of those transactions were for flats below the 25th storey. For The Peak @ Toa Payoh, which has seen four seven-figure transactions this year, the median floor level for these transactions is 38th storeys.

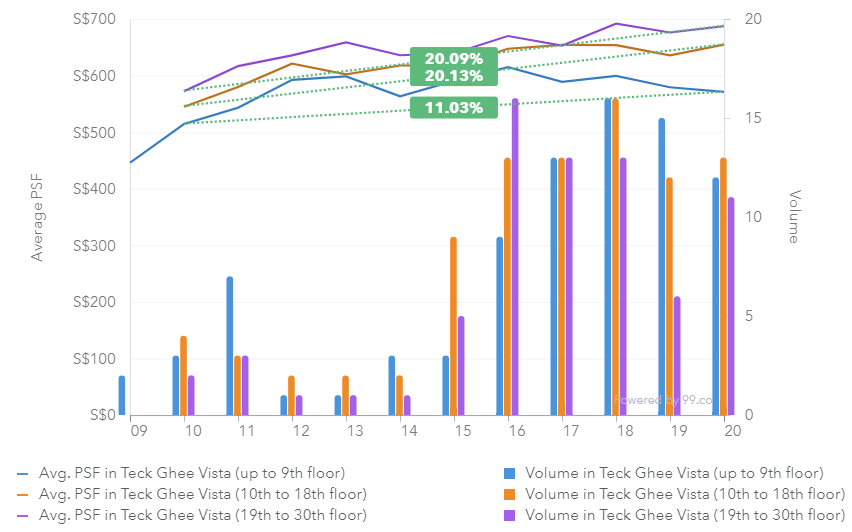

To illustrate the effect that floor levels have in distorting HDB resale prices, we singled out four-room units in Ang Mo Kio’s 30-storey Teck Ghee Vista for comparison:

Evidently, prices of similarly configured flats on higher floors not only fetch a price premium, they may also experience price growth at a higher rate than flats on lower levels.

Also, while prices of units on higher floors are currently experiencing a medium-term uptrend, the same can’t be said of the lower floor units. (Prices of lower floor units at Teck Ghee Vista have been trending down since 2018.)

From this, we can say that HDB resale price trends are being distorted partly because of the increasing number of transactions of super high-floor units in the resale market.

Can we still trust the HDB Resale Price Index?

While HDB Resale Price Index is arguably still a reliable gauge of OVERALL price trend for resale flats, the lack of explanation in its methodology means that Singaporeans cannot simply take it at face value.

The index certainly can’t show us what our data has done, which is to prove that overall price trends may be distorted by newer flats with longer remaining leases, as well as floor level premiums from the sale of newer HDB flats that rise to more than twice the storey height of old flats.

Advertisement

And as the HDB resale market racks up these million-dollar deals, our ministers are once again beginning to focus talk on the ‘lottery effect’ of these newer flats. Perhaps casting the spotlight on the lottery effect, and in the process coming up with enough reasons to curb it, is a way of papering over the growing price divide of newer versus older HDB flats.

This is a rather cynical view, but one that’s justified. The question we need to ask, as more and more estates are seeing million-dollar flats, should be: “Are new BTO flats having the unintended effect of accelerating the decline of resale value of older flats?”

Such a hypothesis could well be correct, and it’s something that will again invoke even more fear among owners of ageing HDB flats. But we can’t run away from it forever, sweep it under the carpet, and blame the lottery effect. One thing’s for sure, we need more independent insights into the HDB resale market, so that we can continue to identify trends that official indices may hide or gloss over to the potential detriment of Singaporeans.

4 days ago · 11 min read ·

Source: 99.co (16 Dec 2020)

Advertisement