Dual-key condo units first hit the market with the launch of Caspian by Fraser Centrepoint Homes back in 2009. Since then, developers have caught on, launching numerous projects across Singapore that feature dual-key units, including Park Place Residences, Kallang Riverside and 120 Grange.

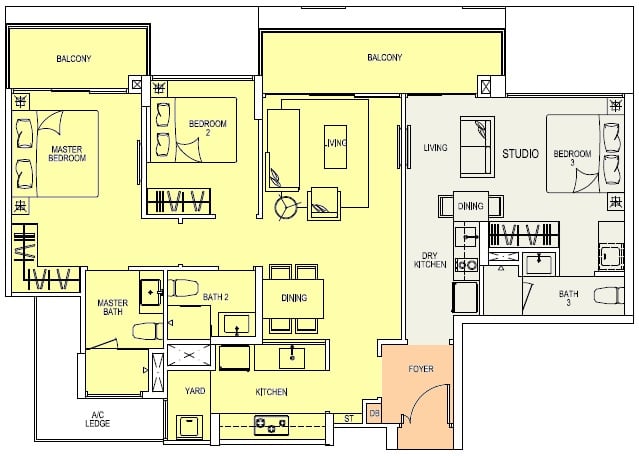

With dual-key units, owners essentially have two self-contained living spaces that share a single foyer and address. The larger unit in an dual-key configuration serves as the main unit, and the smaller unit — commonly a studio — serves as a sub-unit. A dual-key unit is typically 3 to 5% bigger — in terms of floor area — than a regular condo unit with the same number of bedrooms.

As you can imagine, dual-key units are designed to target certain groups of property buyers. Firstly, dual-key units appeal to multi-generation families who want to live under the same roof, but at the same time maintain their own privacy (i.e. elderly parents live in the sub-unit). Secondly, these homes are popular with prospective property investors or couples who are looking to rent out part of their property, but because of affordability constraints do not have the means to buy a second property.

Let’s look at the pros and cons of dual-key units:

Advantages of dual-key units

No ABSD payable

While dual-key condo units are essentially two apartments side-by-side, these are legally a single property. As such, buyers don’t incur any Additional Buyer’s Stamp Duty (ABSD) for the “additional” sub-unit.

With the Singapore government implementing a hefty increase in ABSD in July 2018, dual-key units suddenly made a lot more sense to both first-time homebuyers (with one eye on property investment), and buyers of second and subsequent properties. Buying a dual-key unit lets the buyer “sidestep” the ABSD levied on an additional property, which can be as high as 15% for Singapore Citizens and Permanent Residents and 20% for foreigners.

Say you’ve got a budget of $2 million, and you’re deciding between purchasing a two condo units — a $1.2 million two-bedroom unit for own stay and a $800k unit to rent out — and a dual-key unit. Assuming you don’t own any other property, you’ll have to fork out 12% in ABSD on the second property bought if you go with the former option, which works out to a significant $96,000. For a dual-key apartment, no ABSD is payable if its the first property you’re buying.

Renting out without sacrificing privacy

With dual key units, you get to stay in AND rent out a single property without compromising too much on privacy. As opposed to renting out a room in a regular condo unit, you tenants will be utilising separate keys, living spaces, toilets and kitchen amenities. Landlords and their family members rarely have to rub shoulders with tenants, don’t have to be mindful of the tenant (you’re free to walk around in your nightgown), and can have as much personal space as they need.

Higher per square foot rental yield (compared to standalone studio units)

Renting out a sub-unit instead of a room in your unit not only affords landlords greater privacy, we observed that a sub-unit typically fetches a higher per square feet (psf) rental price compared to renting out a standalone studio unit (i.e. not part of a dual-key unit). Taking the Urban Vista condominium at Tanah Merah as an example:

So, with dual-key units, a prospective landlord is likely to get higher rental yields with a lower cash outlay (when considering it’s also a property for own stay).

[Recommended article: Calculate rental yield in Singapore: a quick and simple guide]

Disadvantages of dual-key units

Dual-key units can be more expensive per square feet

Some developers might price dual-key units significantly higher than regular units with the same number of bedrooms. AtKingsford Waterbay, Kingsford Development priced dual-key units at a whopping 20 to 25% price premium. However, for The Orient, developer Aurum Land did not price in a premium for its six dual-key, two-bedroom units. Given the vast differences in approach to pricing dual-key units, buyers need to do their due diligence to determine if the price premium (if any) is justifiable, especially if buying resale.

Dual-key units can be difficult to sell

Currently, as we mentioned, dual-key units only appeal to a certain segment of buyers, which is in the minority. This means that it might be harder for you to sell your dual-key unit if you want to do so. Buyers outside these niche segments often see dual-key units as an inefficient configuration of space, seeing as they either have no intention of renting out the property, or have parents who are well-settled in another home. So, right off the bat, when you want to sell your dual-key unit, you’ll have to discount at least 90% of the buyer pool.

Tip: If you want to buy a dual-key unit that might be easier to sell, choose one that doesn’t come with a kitchenette (so that the sub-unit resembles a second master bedroom or a junior suite). Beware that doing so could reduce the appeal of the sub-unit to prospective tenants, and lower the amount of rent you can get.

Not suitable as a home office

While entrepreneurs and business owners might be keen on using the second unit in their dual key property as an office space, this may not be the best idea. Utilising a unit in a dual-key property is only viable if you fly solo or have a small team, and if you aren’t planning on expanding in the near future. According to guidelines by the Urban Redevelopment Authority (URA), home offices can only allow for a maximum for two non-residents to be engaged in the business. On top of that, business owners are not permitted to put up any signage outside their property. So, dual-key units may not be suitable as a home office.

Should you buy a dual-key unit?

Ultimately, dual-key units are a niche unit type, where condos are concerned. If being a landlord on a budget is your priority, or if you really want to live with your parents, a dual-key unit can be the ideal solution. For the latter situation, be mindful that there are other factors that still matter more (whether the project is in an area with high rental demand, whether its near to key amenities, how rental yield of similar properties in the area compare etc).

1 year ago · 7 min read ·

Source: 99.co