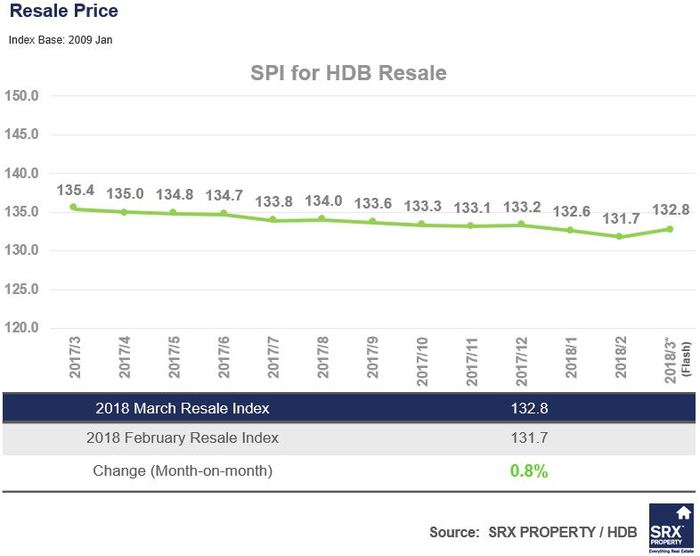

1. HDB resale prices increase in March 2018. There was an increase of 0.8% in HDB Resale prices in March 2018 compared to that of February 2018. The resale prices of HDB 4 Rooms, HDB 5 Rooms and HDB Executive increased by 1.4%, 0.2% and 0.8% respectively, while HDB 3 Rooms decreased by 0.4%.

According to the SRX Property Price Index for HDB Resale:

- Year-on-year, prices have decreased by 1.9% from March 2017;

- Prices have declined by 12.8% since the peak in April 2013;

- There was no price change revision at -0.6% in February 2018;

- Quarter-on-quarter, prices have decreased by 0.6% from Q4 2017. Quarter-on-quarter calculation is based on the index average of first three months of 2018 and that of preceding quarter.

According to the SRX Property Price Sub-Indices for HDB Resale:

- In March 2018, HDB resale prices in mature estates went up by 1.4% and in non-mature estates increased by 0.3%;

- Year-on-year, prices in mature estates have decreased by 1.7% from March 2017;

- Year-on-year, prices in non-mature estates have decreased by 2.1% from March 2017;

2. Resale volume increases in March 2018. According to HDB resale data compiled by SRX Property, 1,894 HDB resale flats were sold in March 2018, a 58.5% increase from 1,195 transacted units in February 2018.

- Year-on-year, resale volume has decreased by marginal 0.8% compared to 1,910 units resold in March 2017.

- Resale volume was down by 48.1% compared to its peak of 3,649 units in May 2010.

3. Overall median Transaction Over X-Value (T-O-X) is NEGATIVE $2,000 in March 2018. According to SRX Property, the median T-O-X for HDB was NEGATIVE $2,000 in March 2018. The median T-O-X for HDB measures whether people are overpaying or underpaying the SRX Property X-Value estimated market value.

- Overall Median T-O-X was NEGATIVE $2,000 in March 2018, decreased by $3,000 compared to the figure in February 2018;

- Median T-O-X for HDB 3 Room, 4 Room, 5 Room and Executive flats in March 2018 were NEGATIVE $2,000, NEGATIVE $3,000, NEGATIVE $1,500 and NEGATIVE $2,500 respectively.

4. Bedok posts the highest median T-O-X. For HDB towns having more than 10 resale transactions with T-O-X in March 2018, Bedok reported the highest median TOX of POSITIVE $7,500 followed by POSITIVE $3,000 in Geylang.

This means that majority of the buyers in these towns have purchased units above the computer-generated market value.

5. Among relatively active towns, Queenstown posts the most negative median T-O-X. Among HDB towns having more than 10 resale transactions with T-O-X in March 2018, the lowest median T-O-X was in Queenstown at NEGATIVE $16,000, followed by Jurong East at NEGATIVE $10,000.

This means that majority of the buyers in these towns have purchased units below the computer generated market value.

Source: SRX