Buying a HDB resale flats comes with its perks–one of it being the generous HDB resale grants you can qualify for.

In 2019, HDB raised the income ceiling for the CPF Family Grant from $12,000 to $14,000 and launched the new Enhanced Housing Grant (EHG), which enable more resale buyers may qualify for housing grants and with a higher maximum grant amount of up to $160,000.

Recommended YouTube Video

These changes could mean that HDB resale flats may turn out to be cheaper than a Build-to-Order (BTO) flat after all, even though BTO flats are sold by HDB at a discount. After all, the Family Grant and Proximity Housing Grant are not applicable for BTO flats.

Plus, the key perks of buying a resale flat is an unlimited choice of locations and the fact that resale flats are already completed and ready for moving in. Resale flats also typically has well-developed amenities, such as schools and eateries, surrounding it.

Now, it’s time to know your HDB resale grants. This article will cover:

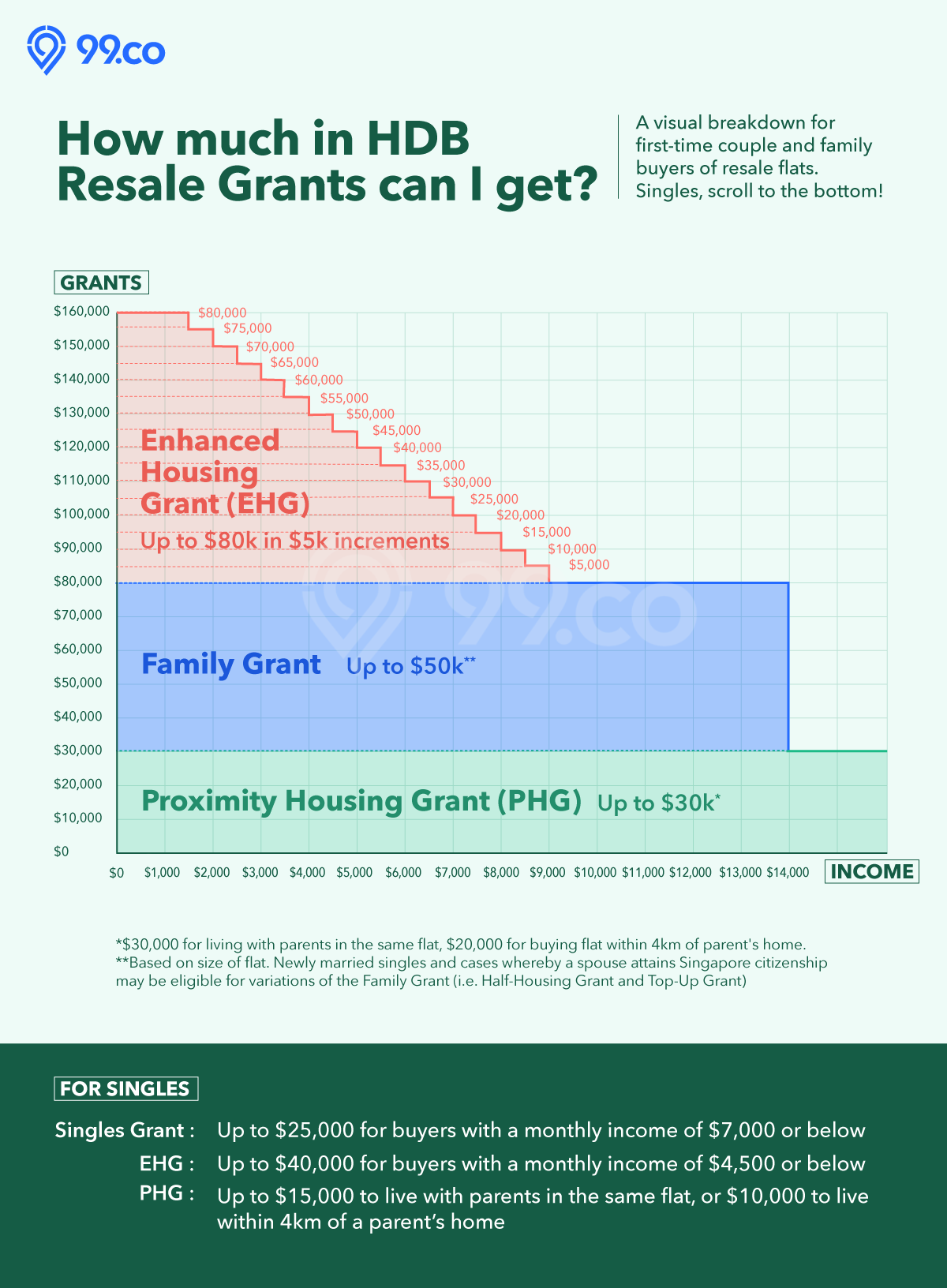

And we’ve created a chart to help you determine the grant amount you’ll get as well, if you’re a first-timer. Scroll down to see it.

Advertisement

Types of HDB Resale Grants

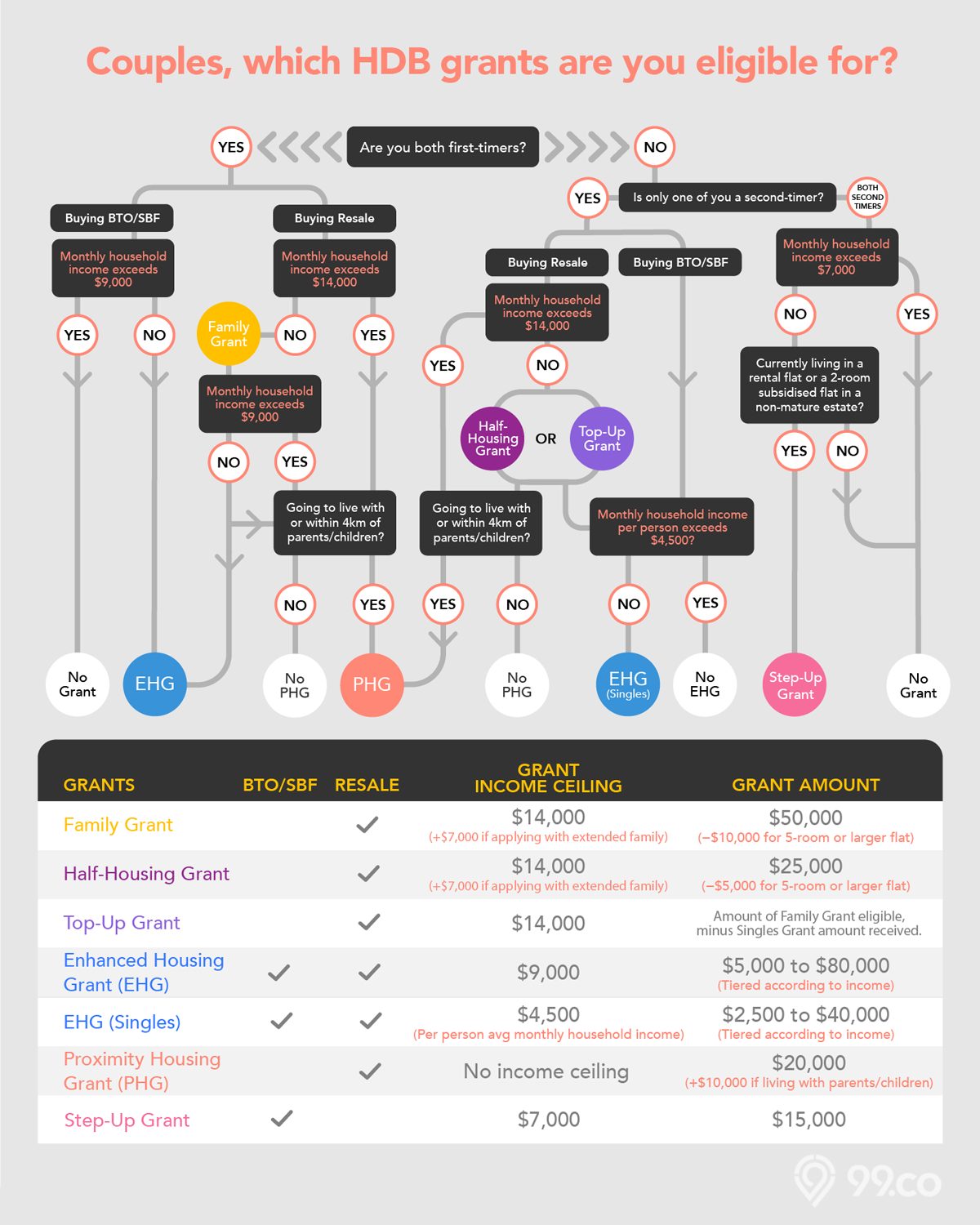

Get ready, it’s quite a long list. (There’s a handy infographic below, too.)

Advertisement

FOR FIRST-TIMER APPLICANTS

To be considered a first-timer applicant, you must:

Advertisement

For Couples/Families

Family Grant (FG)

How much:

Income ceiling:To qualify for the Family Grant, the buyers’ household income must not exceed $14,000. The exception is when applying to live with extended families; for this, the income ceiling is $21,000. The higher grant amount is to encourage older couples or working adults to live with their extended families–including siblings and parents.

Note: The income ceiling for this and other grants is calculated by taking the monthly average of your total household income for the past 12 months.

Who can qualify for the Family Grant:

If one party is a Singaporean Permanent Resident (SPR), they will receive $10,000 less (i.e. $40,000 for two- to four-room; $30,000 for five-room or larger)

Additional criteria:

Advertisement

Enhanced CPF Housing Grant (EHG)

How much:

Income ceiling:

To qualify for the Enhanced Housing Grant (EHG), the buyers’ household income must not exceed $9,000. This is also a tiered grant, meaning that the lower your income, the higher the EHG amount you may be eligible for.

To qualify for the Enhanced Housing Grant (EHG), the buyers’ household income must not exceed $9,000. This is also a tiered grant, meaning that the lower your income, the higher the EHG amount you may be eligible for.

(To know how much in EHG you can get for a specific household income, see our infographic below.)

You can qualify for the EHG if if you meet all of the following criteria:

Additional criteria:

Advertisement

Proximity Housing Grant (PHG)

How much:

Income ceiling:Good news, the PHG has no income ceiling restrictions!

Additonal criteria:

Here’s the breakdown for HDB resale grants in a handy infographic:

You can use the infographic to find out, at a glance, how much in HDB resale grants you may be eligible for. Here’s an example:

Let’s say you and your spouse are first-time applicants, and would like to buy a 5-room HDB resale flat near your parent’s home. With one child and a baby on the way, living near your parents will give you a peace of mind. You will receive:

You are earning $5,000/month, and your spouse is earning $3,500/month. The average gross monthly household income is $8,500. This means:

In this scenario, you’re eligible for a total of $70,000 in HDB resale grants. Not bad!

[Psst, there’s more about BTO/resale grants for couples in this article, which includes a flowchart to help you see what grants you may be eligible for.]

Advertisement

For Singles

First of all, you need to be aged 35 and above to buy a HDB flat as a single.

Singles Grant

How much:

*Singles applying under the Single Singaporean Citizen Scheme will not qualify for the Singles Grant if the flat size exceeds a five-room flat (e.g. an executive flat)

Income ceiling:

To qualify for the Singles Grant, your average household income for the past 12 months must not exceed $7,000 if buying under the Single Singaporean Citizen Scheme (or $14,000 if buying under other schemes such as Joint Singles Scheme)

To qualify for the Singles Grant, your average household income for the past 12 months must not exceed $7,000 if buying under the Single Singaporean Citizen Scheme (or $14,000 if buying under other schemes such as Joint Singles Scheme)

Additional criteria:

Enhanced CPF Housing Grant (EHG) for Singles

How much:

Income ceiling:To qualify for the Enhanced Housing Grant (EHG) for Singles, the buyer’s household income must not exceed $4,500. This is also a tiered grant; the lower your income, the higher the EHG amount you may be eligible for.

You can qualify for the EHG for Singles if you meet all of the following criteria:

Additional criteria:

Advertisement

Proximity Housing Grant (PHG)

How much:

Income ceiling:Good news, the PHG has no income ceiling restrictions!

Additional criteria:

For newly married singles

Previously received a grant as a single but got married? HDB lets you top up your grant!

Top-Up Grant

How much:

Income ceiling:

The combined income of the household must not be more than $14,000 a month, based on the average income for the past 12 months*.

The combined income of the household must not be more than $14,000 a month, based on the average income for the past 12 months*.

*Exception: For Singapore Citizen/Singapore Permanent Resident (SC/SPR) households with the SPR spouse now obtaining Singapore Citizenship status, they are eligible for a Citizen Top-Up Grant of $10,000 with no maximum household income restrictions, although they are subject to other criteria.

You can qualify for the Top-Up Grant if you meet all of the following criteria:

FOR SECOND-TIMER APPLICANTS

Yes, there are grants for you too.

Step-Up CPF Housing Grant

How much:

Income ceiling:The combined income of the houshold must not be more than $7,000 a month, based on the average income for the past 12 months.

For who?

Here are the full terms and conditions.

Half-Housing Grant

How much:

Income ceiling:The combined income of the houshold must not be more than $14,000 a month, based on the average income for the past 12 months.

For who?

This is basically half the amount of the Family Grant. It’s reserved for first-time applicants whose spouse/fiancé/fiancee has previously received a housing subsidy. Like the Family Grant, the average monthly income should not exceed $14,000 or, for those applying to live with extended families, $21,000.

Here are the full terms and conditions.

Advertisement

The maximum amount of HDB resale grants you can get is $160,000.

With the three main grants – Family Grant, EHG and PHG – available for resale flats, you may be eligible to receive a total of $160,000. Pretty impressive, huh?

In comparison, the typical BTO applicants will be eligible for a total maximum of $80,000 in grants, as they may only be eligble for the EHG. BTO applicants do not qualify for the the Family Grant or the Proximity Housing Grant.

And if you are wondering why such a large gap, it is because resale flats are sold at market value, whereas BTO flats are sold by HDB at a discount amount. The discount is mainly due to the additional waiting time involved for a BTO flat to be built.

For certain locations and towns, if you factor in the higher HDB grants available for a resale flat, the cost of buying HDB resale can be even lower than a BTO flat. (Of course, the catch is that HDB resale flats have a lower remaining lease, whereas BTOs come with a fresh 99-year lease.)

How do HDB Resale Grants work?

Submitting the applications for HDB resale grants come after you’ve found a flat you like. Once you and the sellers have agreed on the asking price, and have submitted the Option to Purchase, you will then need to submit a resale application via the HDB Resale Portal (your agent may assist you).

On your resale application, you’ll be asked to specify which CPF Housing Grants you are applying for and to submit supporting income documents.

Once approved, housing grants are disbursed to your CPF Ordinary Account (CPF-OA) to pay for your HDB resale flat upfront. The grant amount is first used to cover any outstanding downpayment of the flat, before being used to reduce the amount you need to loan.

But here’s the catch. When you eventually sell the flat you received these grants for, you will need to return them, as well as a 2.5% per annum interest for every year you’ve had your flat.

To find out more about accrued interest, read this article: How your HDB sale proceeds might get “taken” by CPF

Advertisement

Next step, find your ideal HDB resale flat

Now that you’re all caught up with HDB resale grants, it’s time to start looking for a home. Property portal 99.co has a number of search filters to help you with your search:

2 days ago · 12 min read · Source: 99.co (16 Jun 2020)

Advertisement

Recommended YouTube Video