All hail the HDB Proximity Housing Grant (PHG)—the government’s way of encouraging Singaporeans to stay close to their families and maintain a robust intergenerational support system!

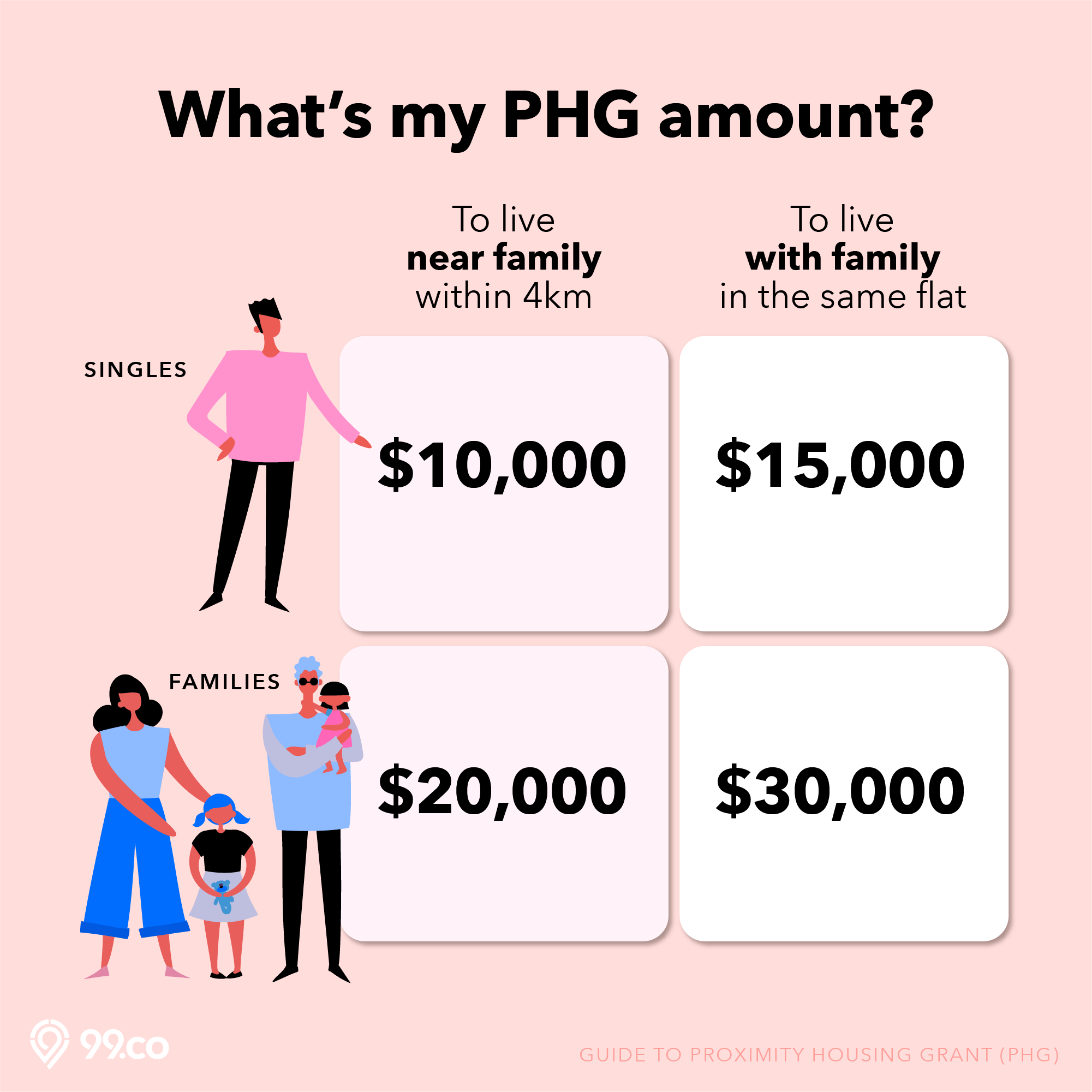

Here’s the basics about the PHG. The PHG is a CPF housing grant of up to $30,000, and it’s for buying resale flats only.

Two types of buyers can benefit: those who want to live WITH their parents/children in a HDB resale flat, and those who want to buy a HDB resale flat NEAR their parents/children.

Recommended YouTube Video

Not only does your flat get subsidised with the PHG, some actual perks to multi-generational living or living close to your family include frequent get-togethers (very Modern Family vibes), the ease of bringing elderly parents to doctor appointments and a peace of mind that an emergency babysitter is close by.

Okay, let’s jump into the details of the PHG.

A brief backgrounder on the Proximity Housing Grant (PHG)

The PHG was launched in 2015 and has since helped over 30,000 households. In 2018, the criteria for PHG was revised to let more Singaporeans benefit from this grant. It is now more inclusive and generous:

*Note that a HDB flat in same town but further than 4km from the other flat from won’t qualify for the PHG. (Read on to find out how to check the distance between two flats!)

Advertisement

Here’s our handy infographic that sums up HDB’s Proxmity Housing Grant (PHG).

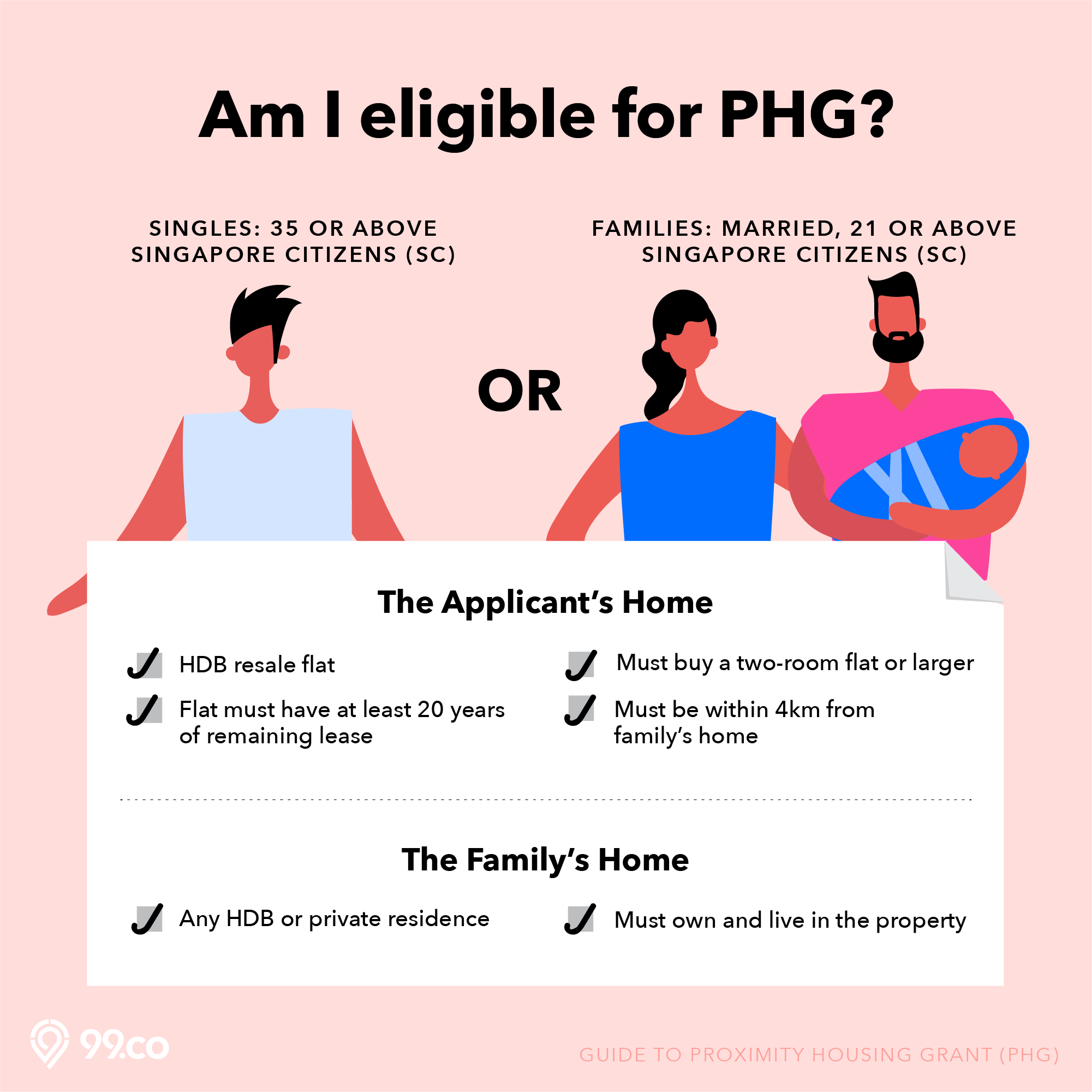

What are the conditions to be eligible for the Proximity Housing Grant (PHG)?

Advertisement

How do I check if a flat qualifies for Proximity Housing Grant (PHG)?

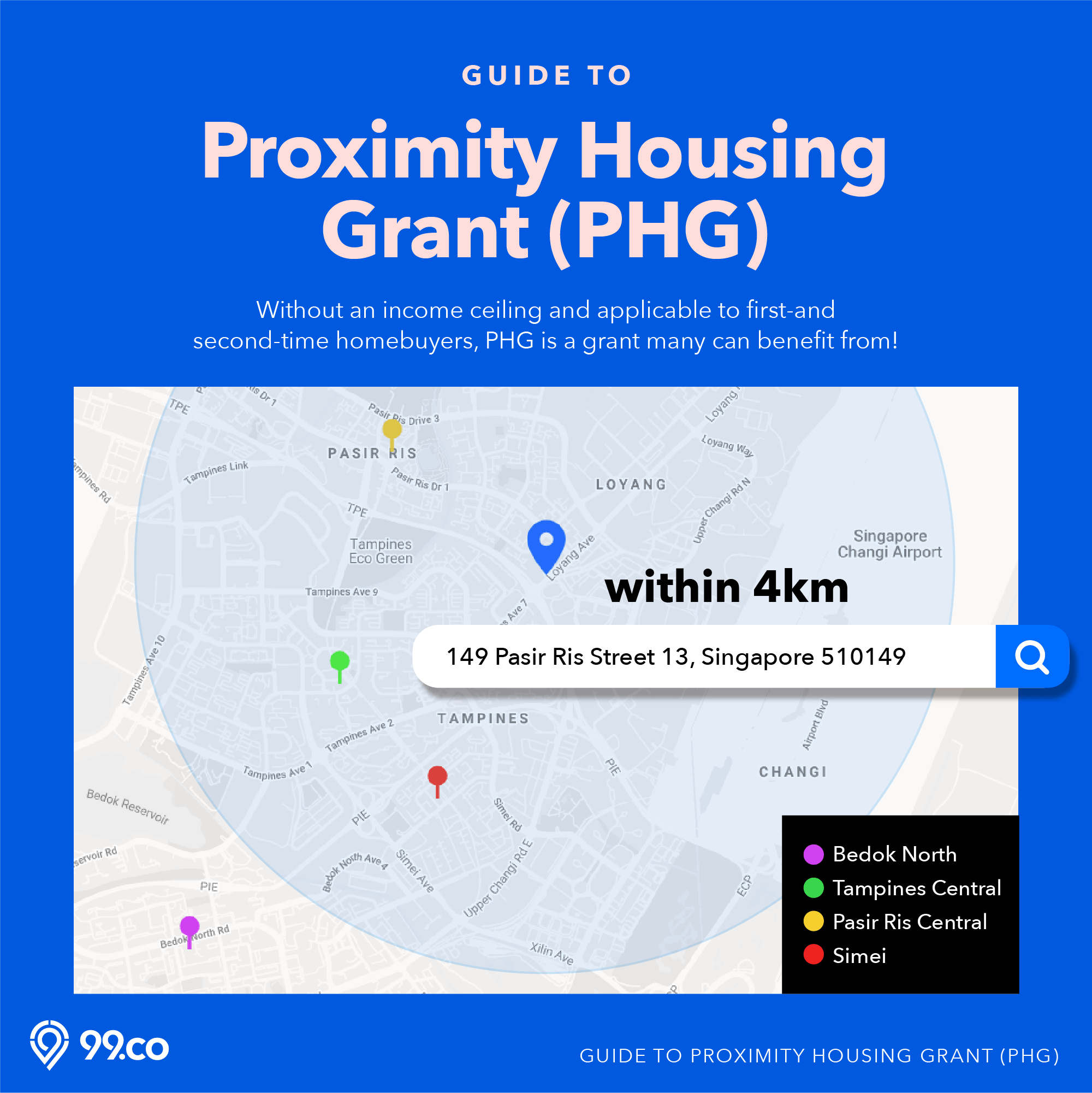

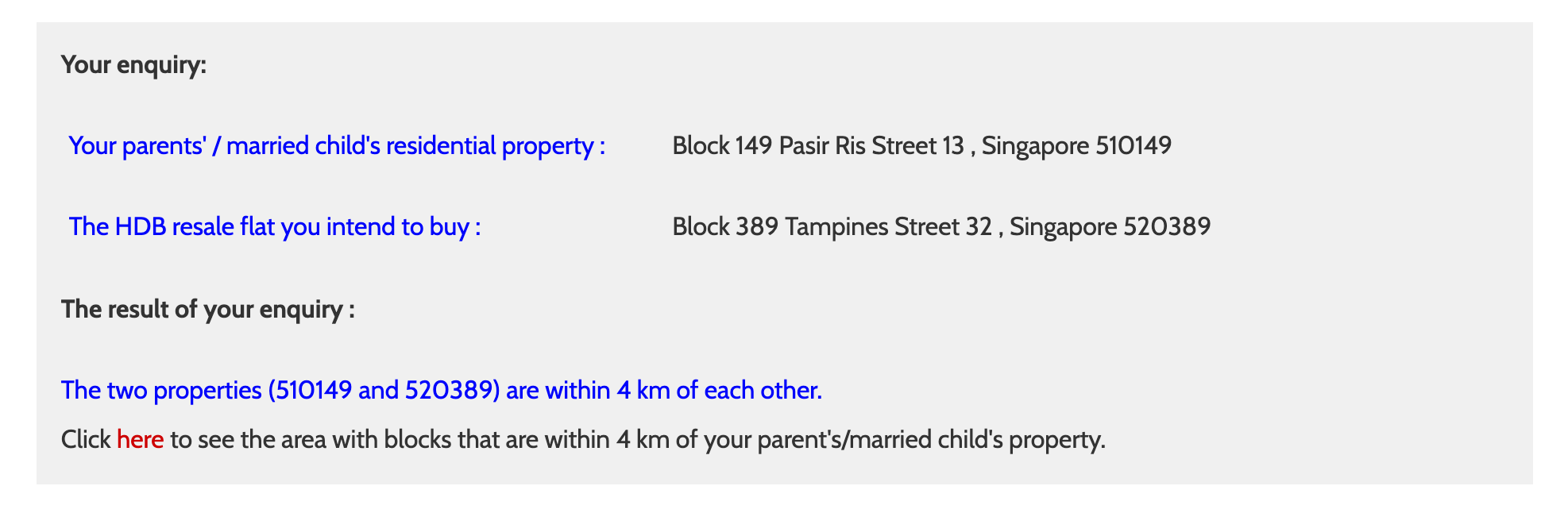

Okay, so what is 4km radius exactly? HDB has set up a Distance Enquiry e-service that lets you check if the HDB resale flat you have in mind is within 4km of your children/parent’s home. Simply key in the postal codes to both properties. Here’s us keying in the postal code of two HDB flats in the east.

There’s also a search function in HDB’s Map Services. While looking at the housing information for a particular HDB address, you can select ‘Distance Enquiry for Proximity Housing Grant’ in the right navigation menu to check which blocks of flats are included within a 4km radius.

There’s also a search function in HDB’s Map Services. While looking at the housing information for a particular HDB address, you can select ‘Distance Enquiry for Proximity Housing Grant’ in the right navigation menu to check which blocks of flats are included within a 4km radius.

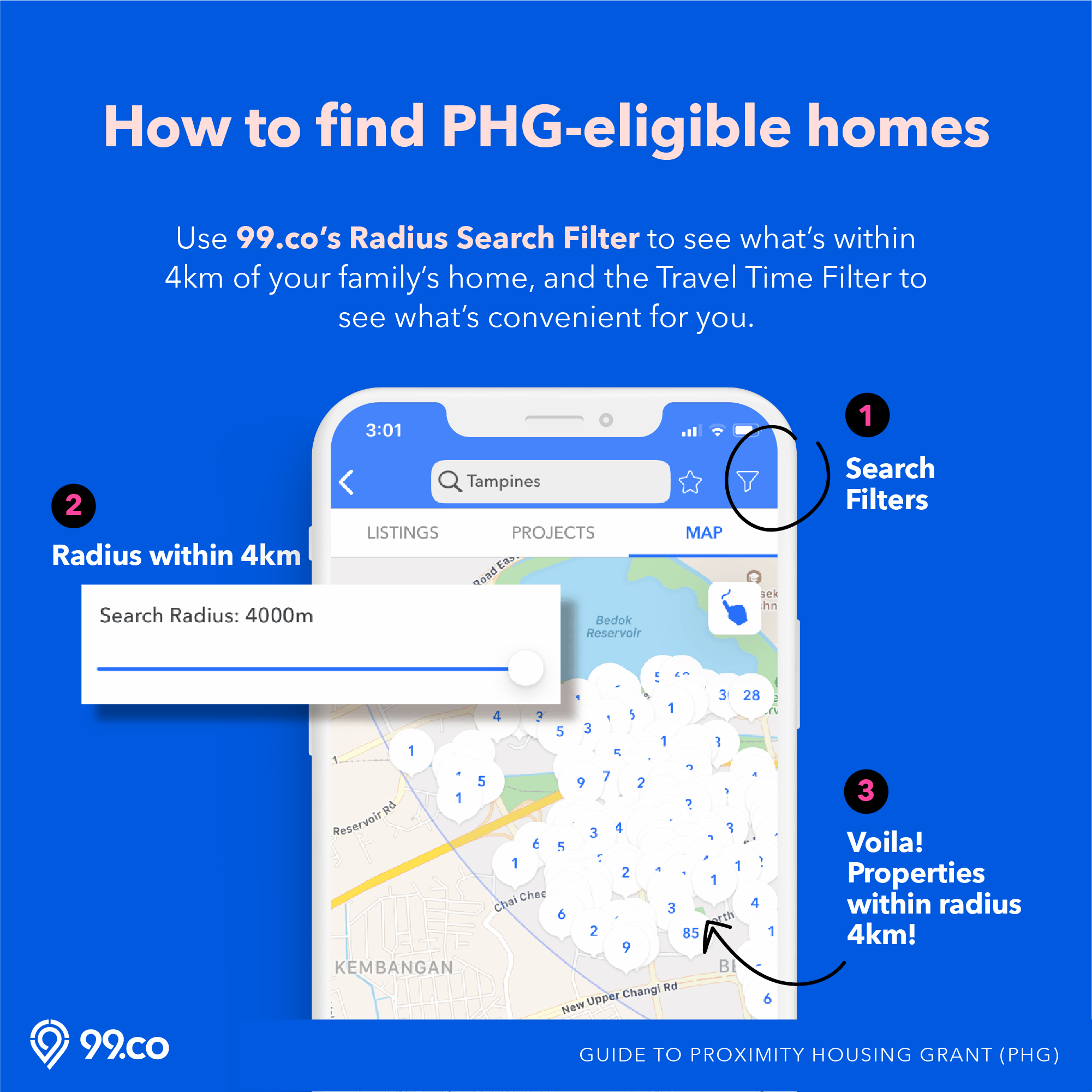

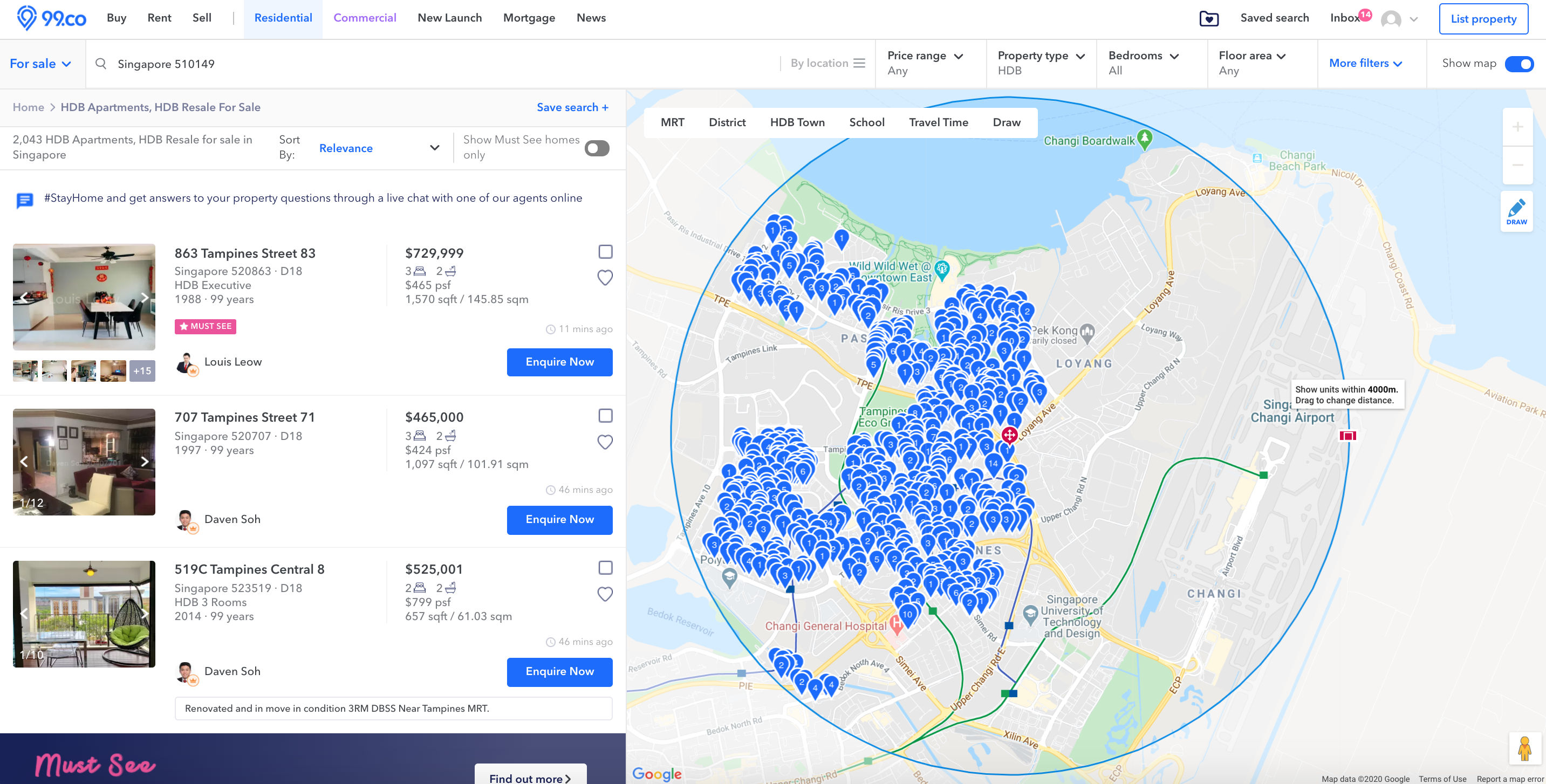

BUT the HDB Map Search doesn’t show you which units are currently for sale. So, if you’re looking to buy a HDB resale flat within 4km of your parent/children, the most straightforward way is to head to property potral 99.co, type in that home’s address or postal code and hit ‘Search’.

Once you do that, you’ll be taken to a results screen with a map view. If you’re accessing 99.co using desktop, point your cursor to the red nub on the right edge of the radius and drag it outwards to it’s maximum 4000m (i.e. 4km). This is our very own Radius Search Filter for the Proximity Housing Grant!

If you’re using the app version of 99.co, you can hit the funnel icon on the top right of your results screen, where you can then set the search radius to 4000m (i.e. 4km) and access a whole lot of other filters to narrow down your search for your dream home.

Do I have to return or pay back the Proximity Housing Grant (PHG)?

A misconception about CPF housing grants, including the PHG, is that they are free. Well, unless you plan to stay in the same house forever–which is unlikely as families grow/shrink overtime–you’ll need to refund the the grants you’ve taken when selling your flat.

This refund comprises the principal amount of grants you’ve received as well as its accrued interest of 2.5% on the grant amount. Accrued interest is the amount of interest your grant could have earned if it had stayed in your OA untouched.

The money will be deposited into your CPF Ordinary Account (CPF-OA)*. And it comes from the proceeds from selling your current flat.

Advertisement

However, the good news is that the amount returned into your CPF-OA may be used to buy your next home.

*Note that if you’ve also taken the AHG, SHG or EHG in addition to the PHG, only a maximum of $60,000 from these grants will go back into your CPF-OA when you sell your flat. The excess will be equally distributed in your CPF Special Account and Medisave accounts.

Am I really living near my parents?

In the Pasir Ris and Tampines examples above, the two flats are a short bus ride and walk apart.

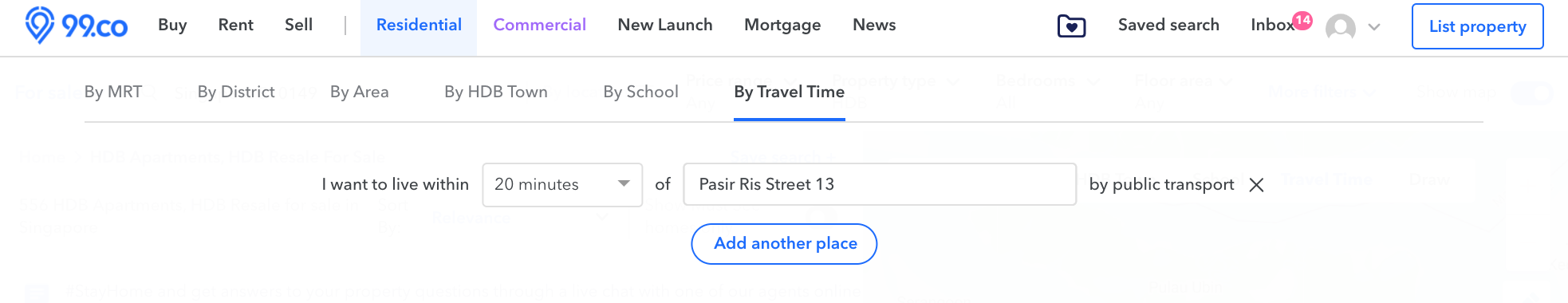

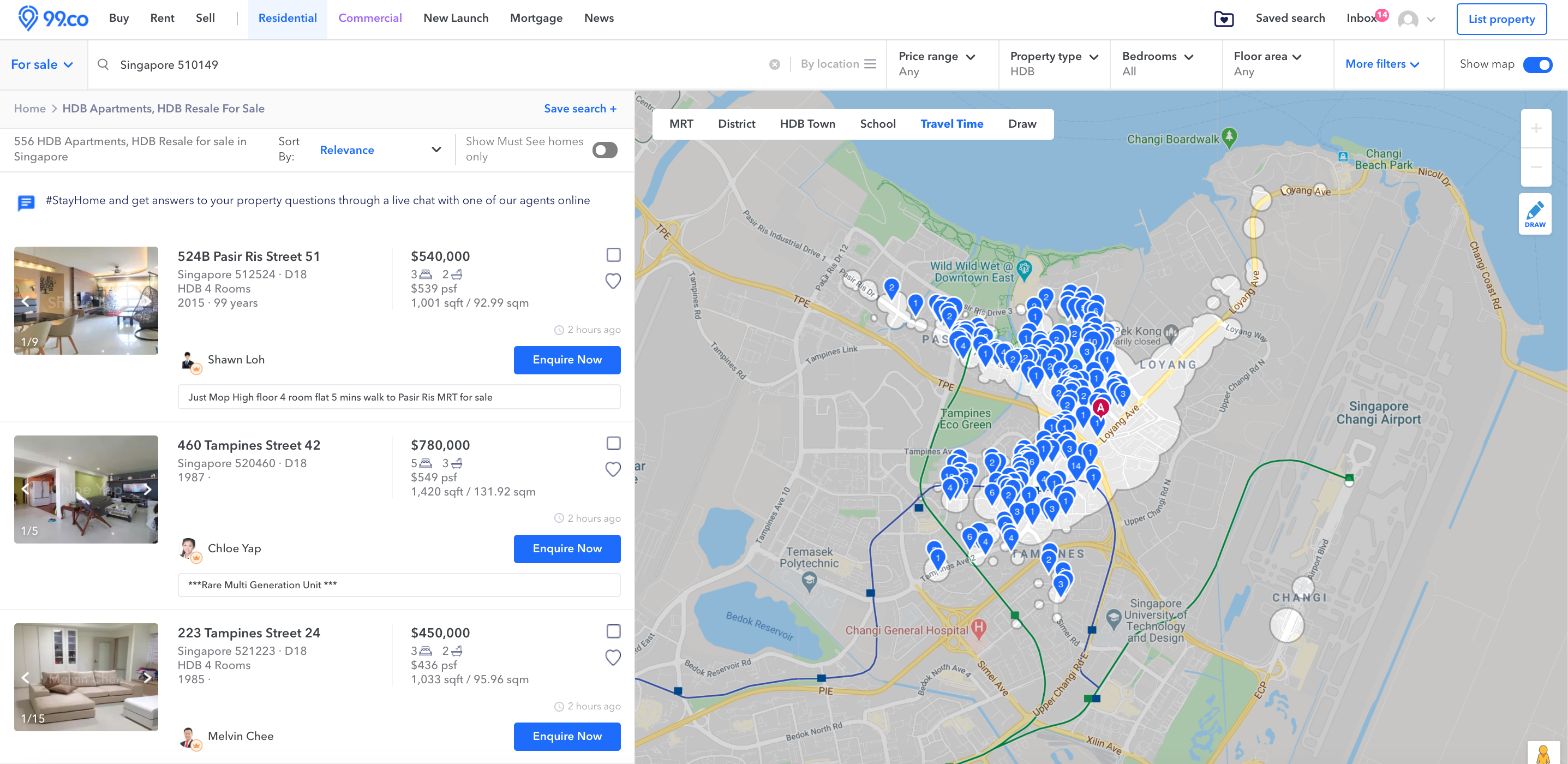

However, not all flats that are within 4km of each other are well-connected. If travelling time between the two homes is an important consideration, narrow down your search for a HDB resale flat using the Search by Travel Time feature on 99.co. Choose a travel time (which is via public transport) that you are comfortable with, say, 20 minutes.

In the search results, you’ll see homes that are within a 20 minute bus or MRT ride away from your indicated address. The Search by Travel Time function can help you find the most ideal resale flats within the 4km PHG radius.

What other grants can I be eligible for?

Other grants available for buyers of HDB resale flats include:

For Singles

For First-time Applicants (Couples/Families)

For Second-time Applicants

For First-time and Second-time Couples

For Newly-married Singles

Good luck with your home search!

Will the PHG give you an incentive to buy a HDB resale flat near your parent’s home? Let us know in the comments section below!

If you found this article helpful, 99.co recommends

Looking for a HDB resale flat? Find your dream home on Singapore’s most intelligent property portal 99.co!

1 day ago · 8 min read · Source: 99.co (20 May 2020)

Advertisement

Recommended YouTube Video