Prices of private homes increased by 1.5% q-o-q in 2Q2019, reversing price falls recorded in the two previous quarters, according to URA data.

“For the first half of this year, prices have increased by 0.8%, which is still within our earlier projection of between 1% and 3% for the full year,” says Christine Sun, head of research and consultancy, OrangeTee & Tie (OTT).

Prices of landed properties decreased by 0.1% q-o-q in 2Q2019 compared with the 1.1% q-o-q increase in the previous quarter. Meanwhile, prices of non-landed properties increased by 2% q-o-q in 2Q2019, compared with the 1.1% q-o-q decrease in the previous quarter.

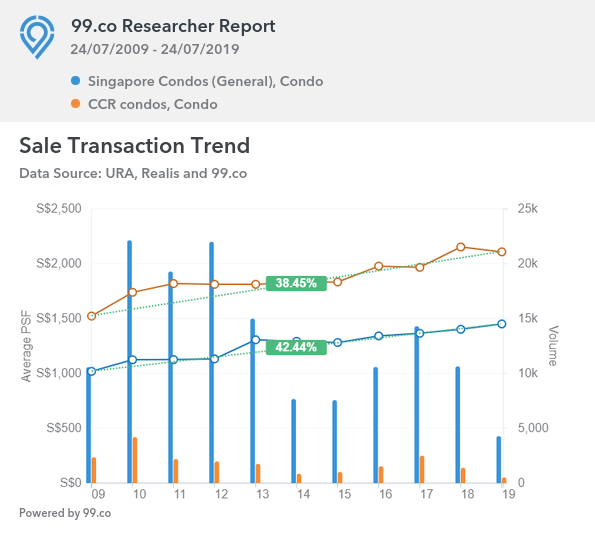

In the Core Central Region (CCR), prices of non-landed properties increased by 2.3% q-o-q in 2Q2019, compared with the 3% q-o-q decrease in 1Q2019. Elsewhere, prices of non-landed properties in Rest of Central Region (RCR) increased by 3.5% q-o-q, reversing the 0.7% q-o-q decrease in the previous quarter. Meanwhile, prices of non-landed properties in Outside Central Region (OCR) increased by 0.4%, compared with the 0.2% increase in the previous quarter.

Lee Sze Teck, Huttons Asia’s director of research, points out that the gains in the CCR and RCR supported the 1.5% increase in the URA price index in 2Q2019. “There were more launches and sales of city fringe projects with average pricing of above $2,000 psf and CCR projects transacting above $3,500 psf,” he says.

He adds: “Rising affluence among residents and non-residents saw them picking up units largely in the price range of $1 million to $2 million. Five years ago, the bulk of purchases were in the range of less than $1 million to $1.5 million.”

Prices of landed properties decreased by 0.1% q-o-q in 2Q2019 compared with the 1.1% q-o-q increase in the previous quarter. (Photo: Samuel Isaac Chua/EdgeProp Singapore)

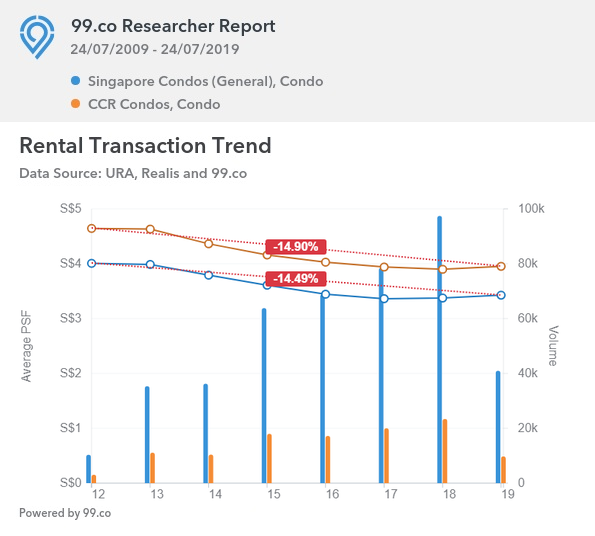

From April to June, rents of private homes rose 1.3% q-o-q compared with the 1% q-o-q increase in the preceding quarter.

According to OTT’s Sun, recovery of rents was mainly driven by the non-landed home segment where rents rose across all three segments – CCR (1.5%), RCR (1.4%) and OCR (1.2 %). “With the growing political uncertainties and social unrest in Hong Kong, some MNCs may plan to shift their headquarters or key operations to Singapore in the long term which will benefit our rental market,” she says.

In 2Q2019, developers launched 2,502 uncompleted residential units (excluding ECs) for sale, compared with 2,989 units in the previous quarter. Likewise, the take-up of new launches also increased q-o-q with 2,350 units sold in 2Q2019, from 1,838 units in the previous quarter.

In the secondary market, there were 2,371 transactions in 2Q2019, compared with 1,858 units transacted in 1Q2019. Resale transactions accounted for 49.7% of all sale transactions in 2Q2019, compared with 49.6% in the previous quarter.

As at end-2Q2019, there was a total supply of 50,674 uncompleted private residential units (excluding ECs) in the pipeline with planning approvals, compared with 53,284 units in 1Q2019. Of the number, 33,673 units remained unsold as at end-2Q2019 compared with 36,839 units in the previous quarter.

According to Ong Teck Hui, JLL’s senior director, research & consultancy, the q-o-q decrease in unsold units could signal the start of the easing of oversupply of private homes for sale.

“After the cooling measures were implemented in July 2018, residential land sales have been relatively subdued. As the addition to supply inventory from post-cooling measures land sales has been outpaced by primary market unit sales, the inventory of units for sale may have started to decline,” he observes.

Ong adds: “However, developers still have to contend with the significant supply of units in the sales pipeline at a time when the market is facing uncertainties due to the economic slowdown.”

By Amy Tan / EdgeProp Singapore | July 26, 2019 3:03 PM SGT

Source: EdgeProp